Contents

Wall Street’s cautious optimism as inflation data hits

2 minutes read

12 August 2025

Once again, Wall Street finds itself on edge, investors watching screens as the latest chapter of America’s economic story unfolds. This Tuesday marks a pivotal moment: the July inflation report lands, ready to influence the Federal Reserve’s path and shake up market sentiment. Across Manhattan, traders sit poised, knowing the data could either vindicate recent bullish bets or spark fresh waves of anxiety.

The waiting game: Traders hold their breath

It’s early morning on the trading floor. Futures hover near record levels, with the Dow, S&P 500, and Nasdaq all showing modest gains in pre-market action. But beneath the surface, nerves run high.

“This week isn’t about wild swings; it’ll be more a process of digestion,” observes Jay Woods, chief global strategist at Freedom Capital Markets. “Sideways movement helps the market calibrate—it’s not a bad thing when you’re this close to all-time highs.”

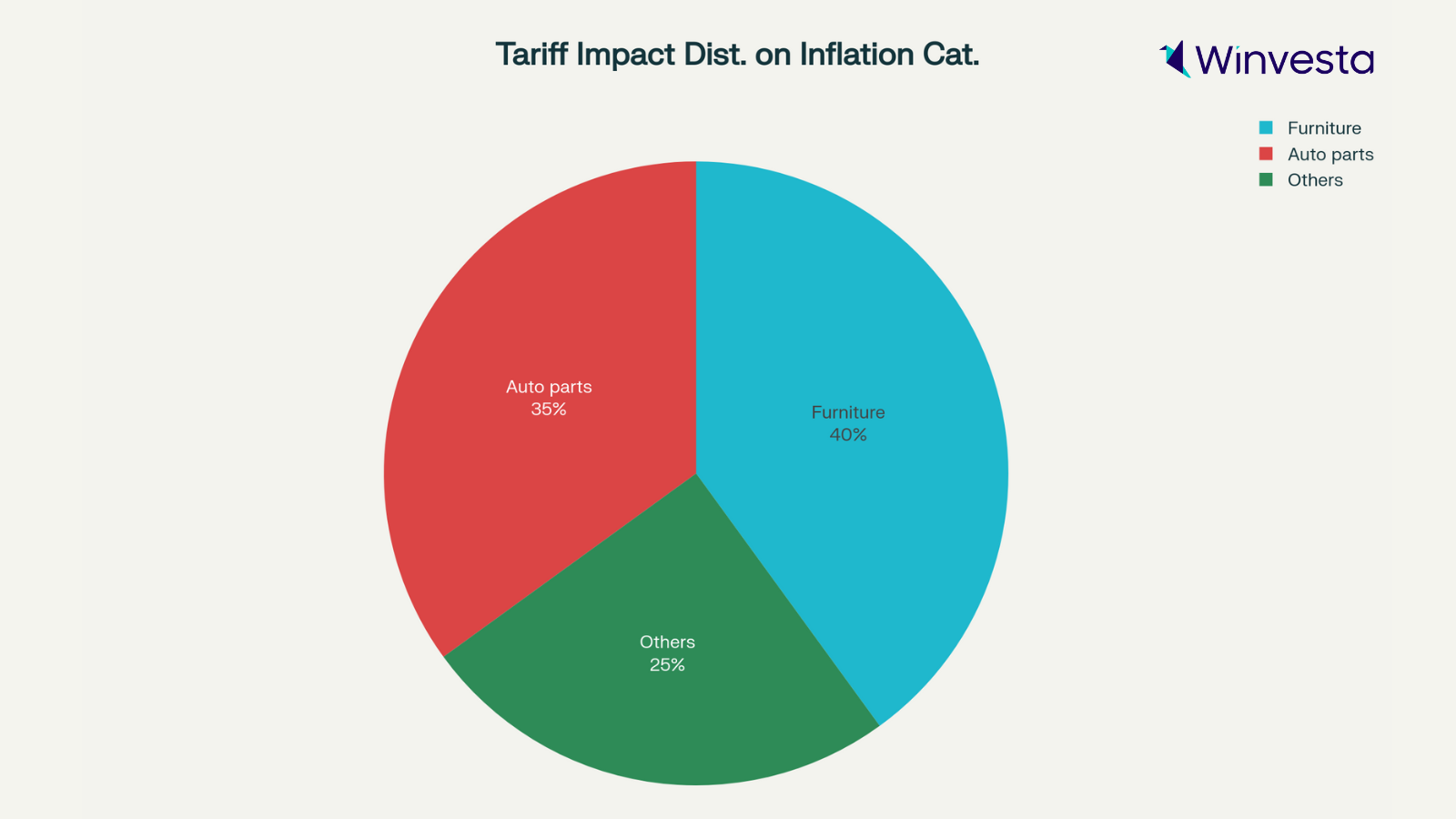

The major indexes have rallied all summer, fuelled by tech and bank stock buybacks, on track to break $1.1trillion in 2025. But with tariffs in play and personal consumption flatlining, today’s inflation print is critical. Goldman Sachs projects core CPI to rise 0.3%, with tariffs adding fresh pressure to categories like furniture and auto parts. Meanwhile, the S&P 500 is just 1% shy of its previous peak, tempting hopes of another record.

Still, uncertainty looms large. “The market is primed for a slight pullback,” cautions Pappardo, multi-strategist at Morningstar Wealth. “There’s a significant amount of anxiety brewing beneath the surface.”

The expert pulse: Is this resilience or a mirage?

Away from the trading desks, economists dissect the numbers. The consensus is clear: inflation inches higher, with annual CPI around 2.8%, edged up by Trump’s latest round of tariffs. A Reuters survey confirms price increases for everyday goods, but services like travel keep a lid on rampant inflation.

Samuel Tombs, senior economist at Pantheon Economics, explains: “Goods prices are moving above trend, mostly on the back of tariffs. But services are holding steady, supported by a rebound in airline fares.”

Others worry about what comes next. “Tariffs and trade announcements last month may have led some firms to reassess the likelihood that tariff rates would come back down, thereby leading them to consider passing on more of the increase in costs,” warns J.P. Morgan’s economics team.

Even seasoned market observers find reason for caution. David Sekera of Morningstar puts it in perspective: “We’ve been in the eye of the hurricane... The market’s normalisation relies on paused tariffs and steady earnings. There’s still potential for volatility ahead.”

And on the retail side, the mood is sober. “We expect ongoing choppiness as markets try to repair themselves and adjust to policy uncertainties,” says Kirsten Cabacungan, investment strategist at Bank of America.

Investors are learning to buy the dips, forging resilience amid the noise. Yet, experts agree: a correction of 10% or more in the S&P 500 remains possible if inflation disappoints or trade talks falter.

As the trading day begins, eyes turn to Washington and the charts. Today, the US stock market dances on the edge, awaiting the next note in the melody of numbers, commentary, and policy. The story is far from finished; but for now, Wall Street is holding its breath, choosing cautious optimism as it rides the inflation wave.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.