Contents

Wall Street eyes the Fed: Nominations, tech stumbles, and earnings buzz

2 minutes read

08 August 2025

A change in the weather rolled through the US stock market today, but not just on the trading screens. Market watchers shifted focus from tariffs and trade talks to the heart of monetary policy: the Federal Reserve. As president Trump announced his nomination of Stephen Miran to the Fed’s Board of Governors, traders paused to take stock of what this could mean for interest rates, inflation, and Wall Street’s next steps.

New faces and old worries at the Federal Reserve

Today, US stock futures crept upward, with the Dow, S&P 500, and Nasdaq each rising about 0.2% in early trading. Investors eyed Trump’s pick for Fed governor, Stephen Miran, chairman of the Council of Economic Advisors, as a sign of possible change on the central bank’s horizon. But the nomination needs Senate approval, and with August recess in full swing, any new direction will have to wait.

Expert opinions split on the news. Spartan Securities’ chief market strategist Cardillo summed up the mood: “The market rally seems to be losing momentum. We saw gains driven by earnings, while it appears the market was overlooking a significant amount of tariff-related news.” Traders remain torn between positive earnings and the lurking threat of tighter monetary policy and higher tariffs.

Interest rates stayed steady last week, but the odds of a cut in September jumped. According to CME’s FedWatch tool, there’s a 93.2% chance of a 25 basis-point cut, up from just 37.7% a week ago. Michael Hacket, chief strategist at Financial, noted, “Signs of fatigue are surfacing. Elevated market valuations and the onset of a usually weak season will test investors’ conviction in the weeks ahead.”

Earnings results shake up tech and pharma stocks

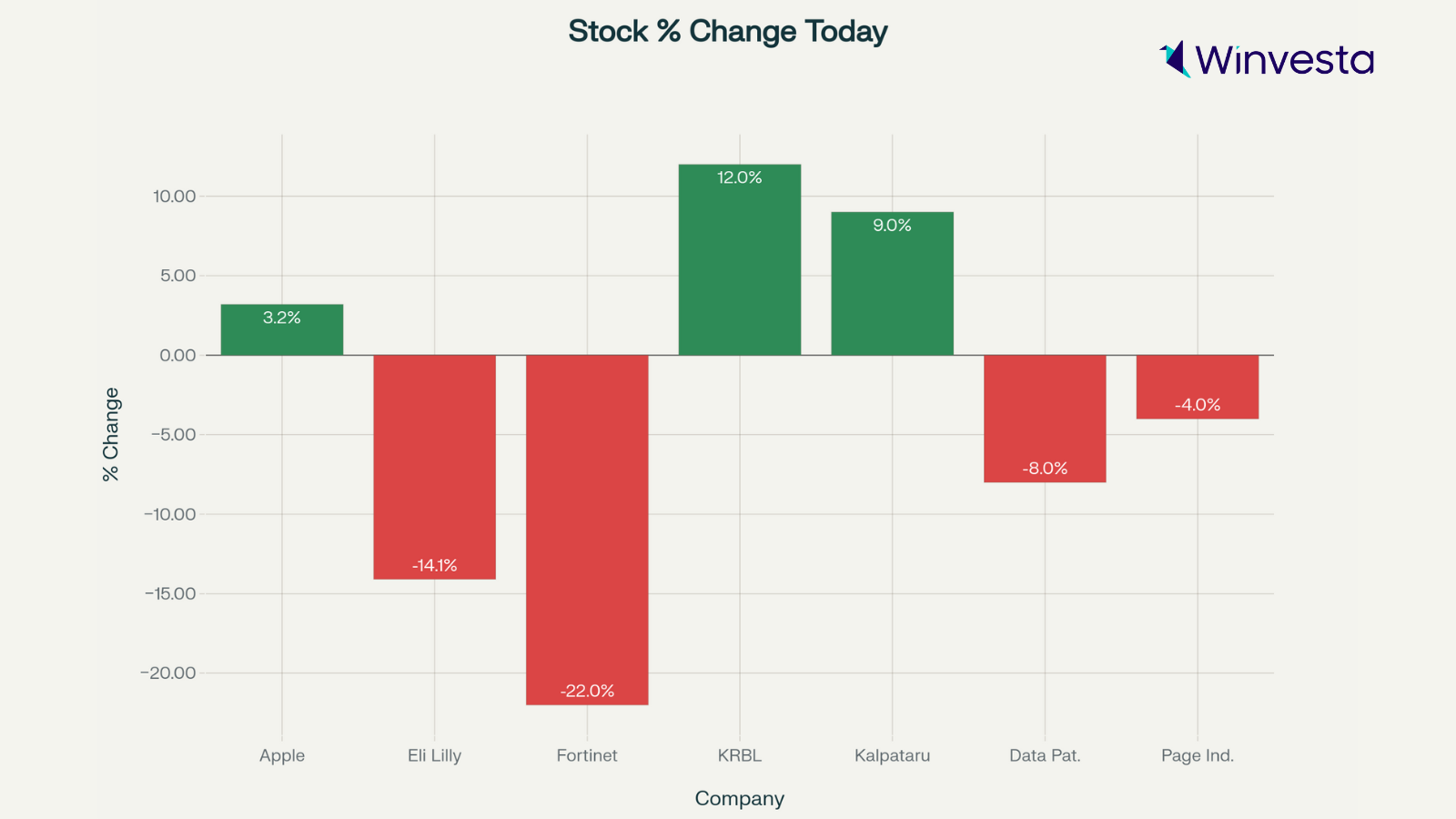

Company earnings provided some fireworks. Pinterest shares slipped after its latest profit failed to meet expectations, bringing a dose of reality to social media investors. Meanwhile, Fortinet dropped 22% after missing revenue forecasts. Eli Lilly tumbled 14.1%—a sharp fall triggered by lacklustre data from its new oral weight-loss drug, even as the company boosted its profit guidance.

On the tech side, Apple grabbed attention as its stock jumped 3.2%. Trump’s new 100% tariffs on chips and semiconductors won’t apply to firms manufacturing in the US or pledging to do so, giving Apple and other major producers a welcome break. Over the week, Microsoft quietly crossed the $4 trillion market cap milestone, underscoring the staying power of the artificial intelligence boom.

Elsewhere, chipmaker Intel faced controversy: activist investors called for the resignation of CEO Lip-Bu Tan over alleged conflicts of interest with Chinese business ties, sparking a 3% drop in the stock price.

Trading volume lagged behind the recent average, and more stocks declined than advanced, not just in New York, but across the Nasdaq too. The Dow dipped 0.5%, S&P 500 dropped just 0.1%, but the Nasdaq eked out a record close, up 0.3%—its seventeenth record finish of 2025.

The message to investors: watch the Fed, company earnings, and tariff announcements as August unfolds. Wall Street’s action is far from over, and as strategist Crill from Dimensional Fund Advisors reminds, “Patience nearly always beats panic. Even with alarming headlines, the market rewards those who stay engaged and think long-term.”

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.