Find your bank's SWIFT/BIC code

Quick and reliable SWIFT code search for your global transactions

Want an affordable SWIFT alternative?

What is a SWIFT/BIC code?

A SWIFT code, also known as a BIC (bank identifier code), is a unique 8- or 11-character code that identifies banks worldwide for secure international money transfers. Whether you're sending or receiving funds across borders, a correct SWIFT/BIC code ensures your money reaches the right destination efficiently.

How to use SWIFT code finder

Follow these simple steps to find your bank's SWIFT/BIC code

Enter your bank name or location

Get the official SWIFT/BIC code instantly

Use it to send or receive international payments

BIC/SWIFT code format

A BIC/SWIFT code is an 8- or 11-character identifier used for international banking. It ensures accurate routing by specifying the bank, country, location, and branch.

Bank Code

Letters only

Country Code

Letters only

Location Code

Letters and digits

Branch Code

Letters and digits

Consists of 8 to 11 characters

How to find your bank's SWIFT/BIC code

Finding your bank's SWIFT code is simple. Use our SWIFT code finder to locate the right code for your transactions. You can also check:

- Your bank statement or online banking portal

- Official bank website or customer service

- Our easy-to-use SWIFT/BIC code lookup tool

Why do you need a SWIFT code?

A SWIFT/BIC code is essential for:

- International wire transfers - ensuring secure and accurate global payments

- Cross-border business transactions - paying suppliers and vendors overseas

- Receiving funds from abroad - get paid seamlessly from clients, employers, or family members

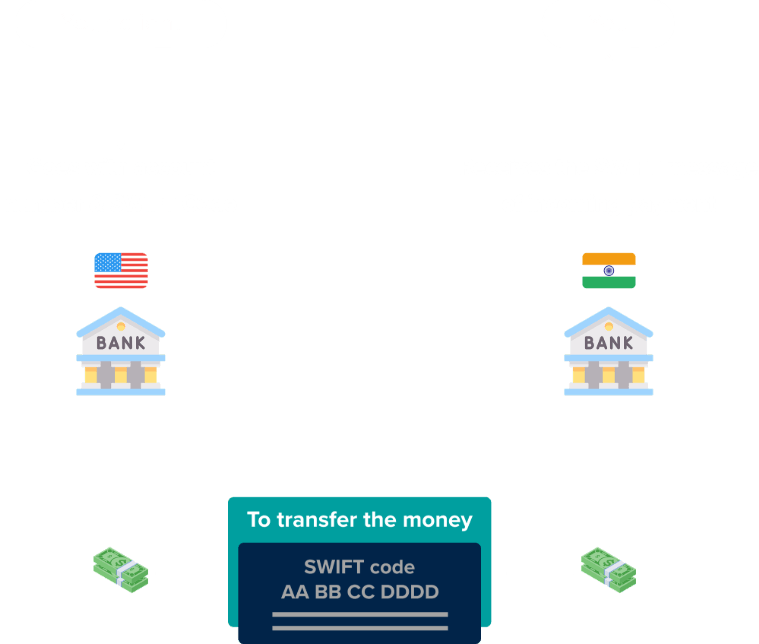

What you need for a SWIFT transfer

To ensure a smooth and secure international transfer, you'll need the following details:

Recipient's details

- ✓Bank account number or IBAN

- ✓Full name and complete address

Bank details

- ✓Bank name and branch address

- ✓SWIFT/BIC code to route the transfer correctly

Transfer details

- ✓Currency and amount being sent

- ✓Purpose of payment (e.g., business, personal, invoice payment)

Identification details

- ✓ID or reference number for both sender and recipient (varies by country and bank)

Frequently asked questions

Contact Us

Address: Famous Studios, 20, Dr Elijah Moses Rd, Gandhi Nagar, Upper Worli, Mahalakshmi, Mumbai, Maharashtra 400011

Phone: +91-(0)20-7117 8885, Monday to Friday - 10:00 am to 6:00 PM IST

Email: support@winvesta.in