Contents

A nervous optimism: Investors brace for a volatile week in US stocks

2 minutes read

11 August 2025

Strong coffee, screens filled with tickers, and one question on every trader’s mind: How will this week’s inflation news shape the market? On Monday morning, Wall Street waits. US stock futures sway, Nasdaq just below zero, Dow and S&P 500 inching higher. But markets have yet to open, and the anticipation feels charged.

Waiting for the shoes to drop

August brings caution to Wall Street. “Markets look stretched and the odds of a 5% dip are not trivial,” says Laila Peters, senior strategist at BlackRock. It isn’t just tradition, it’s the weight of the Federal Reserve’s next move. Tuesday’s Consumer Price Index (CPI) could tip the scales.

Economists expect CPI to rise 0.3% for July. Another surprise, especially on the upside, changes everything. “If the inflation print surprises on the upside, you can forget about a rate cut in September,” warns Priya Misra, portfolio manager at JPMorgan. She adds, “It will hurt both bonds and stocks if you get a high CPI number that's not just driven by goods. It's harder for the Fed to make the case to cut rates.”

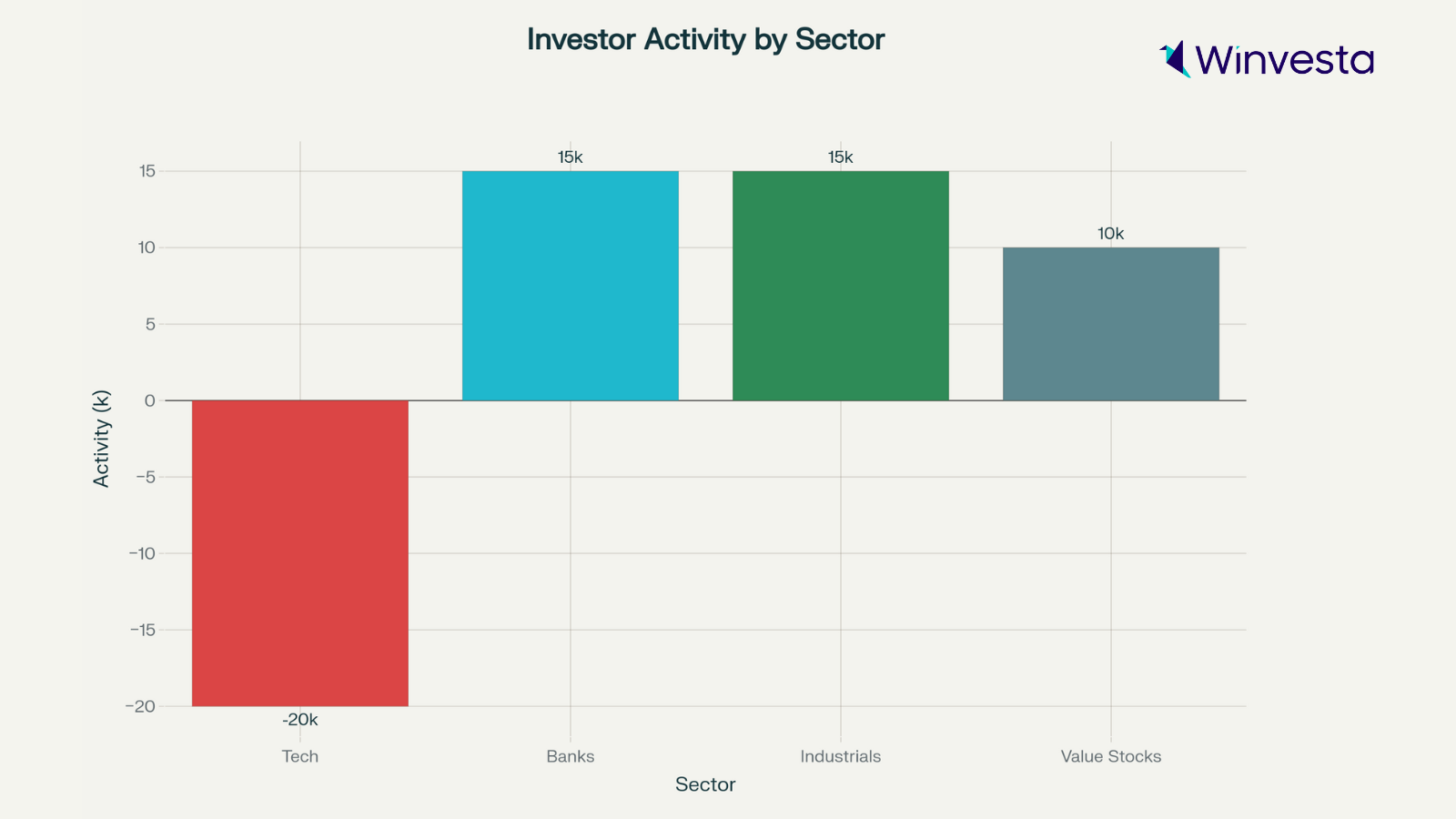

Wall Street analysts, like those at Goldman Sachs, expect tariffs to nudge costs higher, especially for home furnishings. Money managers respond by moving out of tech and into banks and industrials. Chris Harvey, Head of Equity Strategy at Wells Fargo, notes, “We’re seeing a lot more put options on tech and a clear move into sectors that pay dividends.”

Chip stocks waver, eyes on Nvidia

Tech’s stars, including Nvidia and AMD, stumble before the opening bell. Nvidia’s earnings, coming later this month, could be a game changer. “AI is going through an inflection point, the amount of computation we have to do is 100 times more, easily,” says Nvidia CEO Jensen Huang.

Goldman Sachs has upped its price target for Nvidia, but flags the risk: “A hot inflation number could trigger a sharp sell-off in tech shares. Investors are hedging by trimming exposure to corporate credit and upping bets against high-yield bonds,” explains derivatives analyst Terry Nelson.

Two events could move the needle before trading starts, CPI numbers and China’s tariff deadline. Daniel Lee, Moneyweb columnist, says, “It’s classic August, everyone’s waiting for a headline to move the needle.”

Investors watch defensively. Value stocks and banks might gain if growth falters, but the one certainty is uncertainty. With futures flickering and news just hours away, Wall Street sits silent but ready to act. Tomorrow could bring clarity or chaos. For now, the mood echoes across trading desks: nervous optimism.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.