Contents

US stocks walk the tightrope as AI hope faces inflation worry

2 minutes read

18 August 2025

Wall Street holds its breath this Monday morning. With the opening bell just ahead, traders prepare for a fresh round of surprises. Optimism about AI-powered growth collides with the persistent rattle of inflation. In the City and beyond, everyone wonders: will the good news keep rolling—or is a shake-up in store?

Rate cut dreams, AI giants and a shifting landscape

The S&P 500 sits just shy of a record 6,464, ready for its next move. Tech—especially the AI names—has led the way. Had you invested £10,000 in a S&P 500 tracker this time last month, your stake would have notched up about £250 by now. But markets don’t just hinge on the past.

Victoria Greene, Chief Investment Officer at G Squared Private Wealth, told CNBC days ago: “Investors have clearly priced in a September Fed rate cut, but with persistent inflation, we could get a surprise. Stay nimble”. Her note of caution is echoing through trading rooms. All eyes are now on the Federal Reserve’s upcoming Jackson Hole gathering. Will rates finally fall? Or will policymakers stand their ground?

UnitedHealth has drawn bullish bets since Berkshire Hathaway increased its stake. Defensive names in healthcare and consumer staples have seen interest rise, hinting at caution underneath the optimism. Bill Stone, Chief Investment Officer at Glenview Trust Company, explained: “When you see that tilt into healthcare, it’s the market saying: we want growth, but we also want safety”.

AI stocks remain the centre of attention; investors keep chasing tomorrow’s winners. Yet, some market strategists are wary. “We’re in an everything rally, but that can reverse quickly if the data go sideways,” warned Michael Arone, Chief Investment Strategist at State Street Global Advisors in a June interview with Kiplinger.

Winners, losers and the inflation wild card

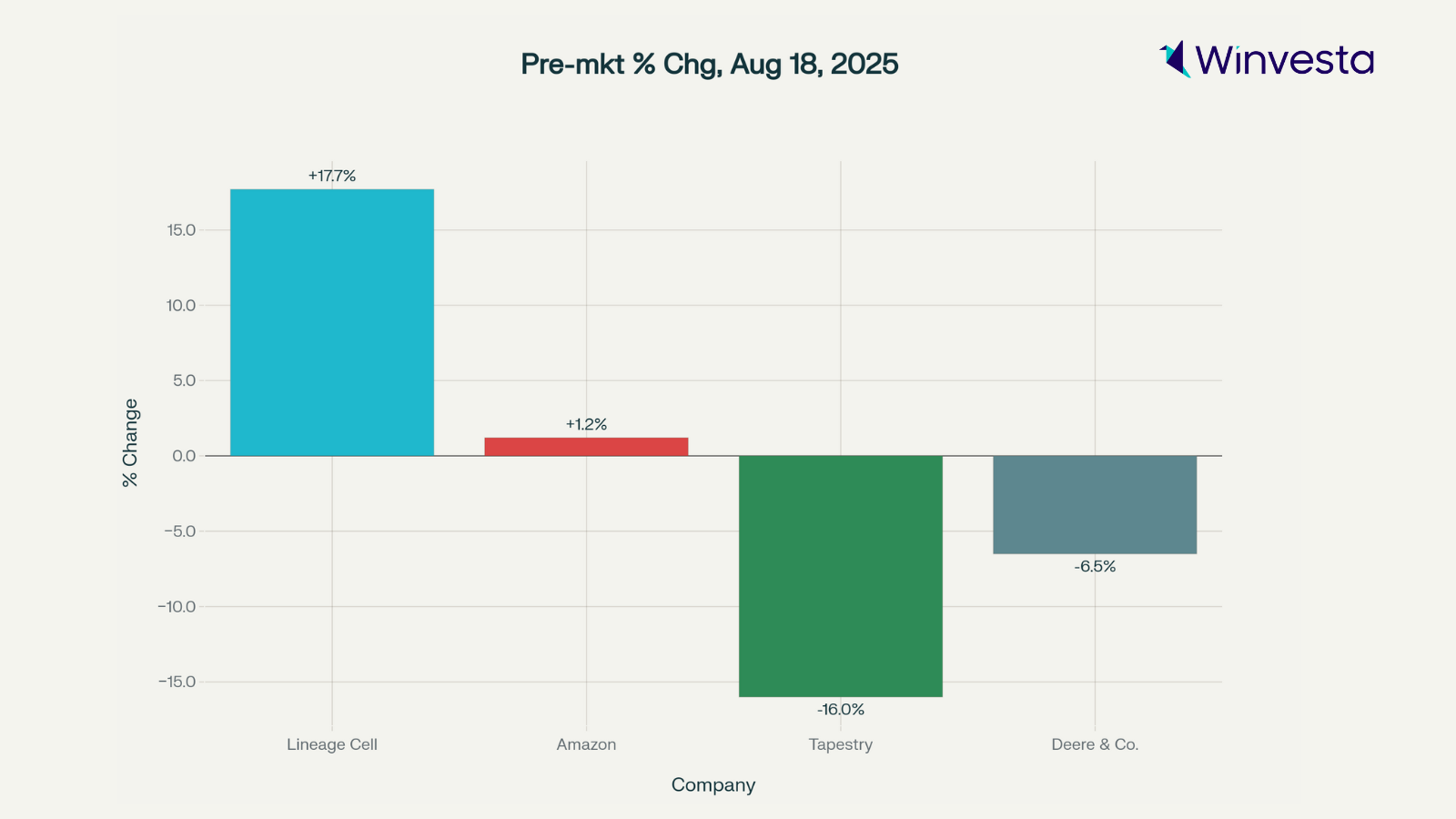

Pre-market movers hint at both opportunity and risk. Biotech name Lineage Cell Therapeutics (LCTX) is setting up for a surge, with traders buzzing about fresh breakthroughs. Meanwhile, Tapestry—owner of Coach and Kate Spade—faces a sharp drop after disappointing earnings. If you’d put £1,000 on Tapestry at the open today, you might see it shrink to £840 by the close—an example of how quickly sentiment can swing.

Industrial bellwether Deere & Company looks set for a rough ride, battered by talk of weaker global demand. Tech giants like Amazon are holding steady in pre-bell trading, a reminder that favourites still attract buyers even as storm clouds brew.

This week’s real drama may break outside the trading screens. Markets await key economic signals, from Purchasing Managers’ Index (PMI) data to the Federal Reserve’s July minutes. S&P Global highlights the risk: “Any rise in the PMI Output Prices Index could point to higher inflationary pressures in the months to come and pose additional threats to rate cut expectations.” With those numbers on deck, the coming days promise sharp moves and sharper debate.

In times like these, calm heads matter most. In today’s market, being prepared—for anything—remains the best trade of all.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.