Contents

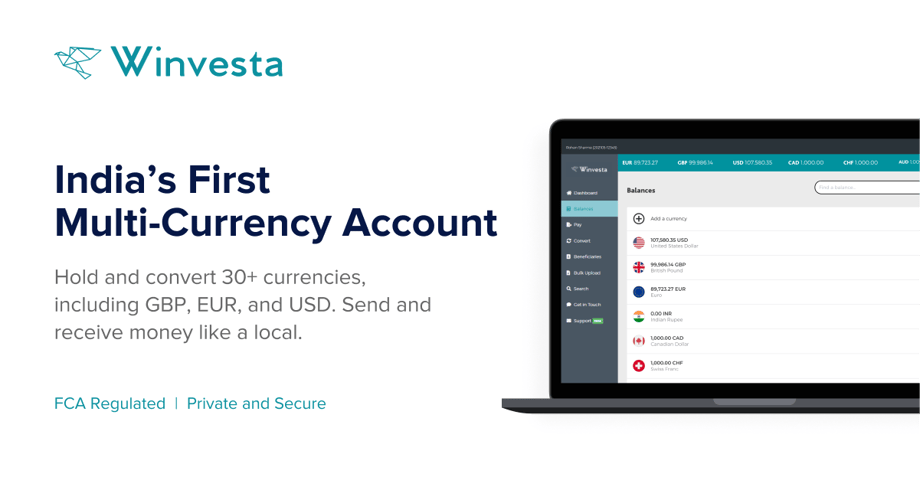

Winvesta Launches India's First Multi-Currency Account

3 minutes read

30 March 2025

Press Release

Highlights

- The multi-currency account enables one to transact in over 30 currencies, including the US Dollar, the British Pound and Euro

- Create an account within minutes with a one-time setup fee of ₹ 399 & start with as little as $50

- The cash is safeguarded with large banks like Barclays, who keep it ring-fenced from their operations and lending, ensuring that client funds remain safe at all times

- Customers can save up to 75% on FX costs

India, 8 July 2021: Winvesta, a financial services firm headquartered in the UK, through its Indian operations has launched the country’s first multi-currency account. The account can be opened online thereby allowing Indian residents to diversify and hold their funds abroad. Customers can now receive, save, invest and spend globally in 30+ currencies seamlessly, using one platform. The multi-currency account can be used for multiple purposes like funding overseas investments, saving for overseas education, receiving foreign income, or having an account before moving abroad. Students can create an account without a visa, SSN, or university admission letter, and continue using the account when abroad.

For long, what was a privilege for only a few, is now accessible to everyone without waiting for months or needing a high threshold of over USD 50,000 to open a foreign currency account. With Winvesta, customers can onboard within minutes using their PAN and Aadhar details/credentials and start with as little as $50. While transferring money from India, it generally gets credited between a few hours to 2 business days thus making it hassle-free.

Mr. Swastik Nigam – Founder and CEO – Winvesta, said, “We are proud to have launched India’s first multi-currency account, a massive achievement for our company to have done this in such a short time. We want to ensure that we protect the interests of our clients, and the best way we can do that is by being regulated ourselves and offering more than just a technology platform.”

Mr. Prateek Jain – Co-founder and President – Winvesta, said, “Whether it is investing in US stocks or property in the UK, investors need a foreign currency account for maintaining and reallocating investments. In the absence of a foreign account, you need to withdraw funds to India and then remit again, getting a double whammy on foreign exchange costs and transfer charges. It would also count against your LRS quota. Winvesta’s multi-currency account will make investing overseas smoother, and the user can save a great deal in transaction costs.”

Alan Gemmell, Her Majesty’s Trade Commissioner for South Asia and the British Deputy High Commissioner for Western India, said, “I am delighted that Winvesta has decided to expand their offering in India. Winvesta is one of many great UK-India fintech stories that are making banking and payments easier for millions of consumers and businesses and creating jobs. The UK and India are already two of the world’s biggest fintech economies. Our Governments have built a strong partnership which will see us grow stronger together in this exciting sector.

The multi-currency account enables you to transact in over 30 currencies, including US Dollar, British Pound, and Euro. With a built-in currency conversion, customers can exchange currency whenever required and can smoothly withdraw funds to India at competitive exchange rates. The cash in the account is secured under the UK’s e-money regulations, which means that Winvesta and the e-money institution the company works with cannot use clients’ money for lending, investing, or any other operations. The cash is safeguarded with large banks like Barclays, who keep it ring-fenced from their operations and lending, ensuring that client funds remain safe at all times. Along with funding overseas investments and receiving foreign income, customers can also open an account before moving abroad. Each user gets unique account details for each currency, including IBAN, SWIFT code, etc. One can receive foreign currency in these accounts, and send money to over 180 countries.

The account has a one-time set-up fee of ₹ 399 and a flat fee of $1 on payments made from it, with a monthly fee of $2.99. Currency conversions have no fixed fee, while incoming payments are free. One can save up to 75% on FX costs. All the charges are transparent and displayed upfront in the pricing plan. Furthermore, customers can receive up to a full year of free membership by inviting their friends to the platform. In the base plan, there’s a limit of $5,000 per transaction, with no limit to the number of transactions per day.

As overseas investments under the Liberalised Remittance Scheme (LRS) are gaining popularity in India, Winvesta, with its multi-currency account, aims to be the hub of all global investments for Indian investors. Last year, the company had launched a US stock investing platform for Indians, for which they were awarded ‘Fintech of The Year 2021 for the Asia Pacific’ by Barclays. While the multi-currency platform is the latest addition to their product suite, the firm is now working on a multi-currency debit card linked with the account.

About Winvesta

Founded by former Deutsche Bank veteran trader Swastik Nigam, Winvesta Ltd. is headquartered in the UK.

Winvesta is spearheading the change in the complex and expensive process of investing overseas by bringing global investing to the fingertips of Indian investors. Built by an international team of finance professionals with a combined experience of over 50 years in the field, the firm’s product suite includes US stock trading and international multi-currency accounts. Using Winvesta’s regulatory status and technology partnerships, customers can open accounts in as little as 10 minutes.

For more information, please visit – winvesta.in/mca

For media queries, please contact: media@winvesta.in