Contents

Liberalized Remittance Scheme - How can I make the most of it?

2 minutes read

14 May 2024

Liberalized Remittance Scheme (LRS) is an RBI scheme that is available to all Indian residents, including minors. Under this provision, a resident individual can remit up to the US $250,000 per financial year overseas for permitted current or capital account transactions. In the case of a minor, applicable documents need to be signed by the natural guardian. This scheme allows Indian residents to use these funds for approved overseas investments, including capital investments in foreign stock markets. LRS can also be used for investments in real estate or alternative investments under capital transactions. For current account transactions (expenses), this limit can be used towards travel, medical treatments, education, gifts & donations, and maintenance of close relatives, etc.

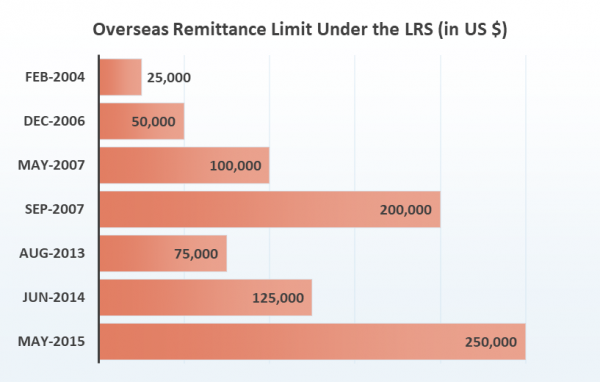

The LRS was introduced in 2004 with an initial limit of US $25,000 and the limit has been revised multiple times based on the prevailing macro-economic factors. The limit was increased to $250,000 per financial year in 2015.

There is no restriction on the frequency of the remittance. However, the total cumulative foreign exchange purchased from or remitted through sources in India should not exceed USD 250,000. Once this limit has been utilized, the resident is not allowed to make any further remittances under the LRS, even if the proceeds of the overseas investments are brought back into the country. This is an important point and Winvesta can help investors rebalance their portfolios by reinvesting any proceeds from previous investments. Investors can use the Winvesta international multi-currency account to receive the proceeds, convert to a different currency at best-in-class FX rates if needed, and transfer to the next international investment choice, without using the LRS limit again.

As an Indian investor, this scheme can be leveraged to become part of the global wealth story. Returns in US stock markets have beaten returns in Indian stock markets when adjusted for FX, and one can see how much more money one would have made in the last decade if she invested in US stocks rather than Indian stocks. LRS allows Indian residents to diversify their portfolio to include international assets which can offer several benefits to the investor. Exposure to international assets can be based on the risk tolerance and preferences of the investor. In general, developed markets assets are more stable than investments in emerging markets. For getting the maximum value out of the LRS scheme, one must note the following points.

- Expenses and investments both count towards the individual LRS limit. If you are traveling overseas, any FX conversions that you do through your bank or card will automatically get counted towards the LRS limit.

- The limit is per individual, including minors. This means that a family of 4 can remit up to USD 10,00,000 per financial year.

- The limit resets on 1st April every year.

- If there is a big international expense like foreign education coming up in a few years, it may be prudent to start remitting and building a liquid international portfolio in advance. This would help protect against the FX fluctuations and any changes in the LRS limit later. One can also save for purchasing a high value international property in a similar manner.

- Any investment proceeds brought back into the country will not increase the LRS limit for the financial year. If the investor has already used up the LRS limit for the current year, more capital can only be remitted in the next financial year.

By liberalizing remittances RBI has enabled Indian residents to participate in global growth. Motivate investors can utilize this scheme to diversify their assets and find unique investment opportunities that suit their individual investment goals.

Free e-book: How to Build a Globally Diversified Portfolio from India

Get a step by step guide including the considerations, current channels, and costs for building an efficient global portfolio.

Get Started

Contributed by Prateek Jain

He is the Co-founder & President of Winvesta. Before Winvesta, Prateek worked at Deutsche Bank for 11 years