Contents

Explained: Benjamin Graham’s Seven Criteria for Selecting Value Stocks

6 minutes read

13 September 2024

Imagine this: you're walking through a flea market. Among the random knick-knacks, you spot a rare, vintage watch worth far more than its dusty price tag. You grab it, knowing you’ve struck gold. That's exactly what value investing is like. You find hidden gems in the stock market that others overlook.

Benjamin Graham is the mastermind behind value investing. He taught us how to find these ‘diamonds in the rough.’ By following his principles, you can learn more about stock trading. Let’s dive in.

The core of value investing

Value investing is a smart way to pick stocks by looking at how well a company is really doing instead of just watching if the stock price goes up or down. The idea is that sometimes the market makes mistakes and prices good companies too low. This gives investors a chance to buy those stocks at a bargain and earn money when the stock price goes up later.

Benjamin Graham: The pioneer of value investing

The Godfather himself, Benjamin Graham, has laid out the principles for investing in stocks, and you should be paying attention. The late Benjamin Graham is considered one of the best value investors to ever exist. Ask Warren Buffet if you don’t trust us. Benjamin Graham is also the author behind ‘The Intelligent Investor’- the book your favourite stock expert probably goes to sleep with. He is known to be one of the earliest proponents of the value investing strategy back in the 1920s, and this is why you should care.

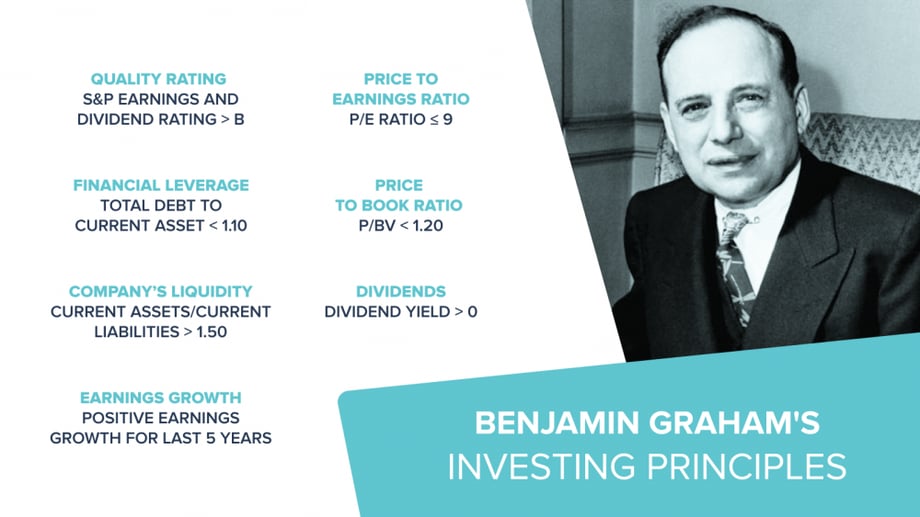

Graham's 7 criteria for selecting undervalued stocks

Graham developed seven key criteria for identifying undervalued stocks. These serve as a guide for investors looking to navigate the stock market and find value-driven opportunities.

1. Quality ranking: Stability and growth

Think of this as checking a student’s grades before tutoring them. You want to invest in companies that have a solid report card. Graham suggested choosing companies rated as average or above by agencies like Standard & Poor’s (S&P). These grades reflect a company’s growth and stability over the last decade, giving you a glimpse into its future potential.

2. Financial leverage: Manageable debt

Ever seen a runner trying to win a race while carrying a heavy backpack? That’s what it’s like for companies with too much debt. Graham believed in betting on companies with a manageable debt-to-asset ratio, ideally no more than 110% for industrial companies. Too much debt means less flexibility to navigate tough times. You want your companies to be light on their feet.

3. Liquidity: Ability to meet obligations

What if you’ve bought a dream car but cannot afford the fuel? A company might look great on paper, but if it can’t cover its short-term obligations, it’s headed for trouble. Graham suggested seeking companies with a current ratio of at least 1.5, meaning they have enough assets to cover their immediate debts. No one likes to run out of gas halfway through the journey.

| Key Metric | Graham’s Benchmark |

|---|---|

| Debt-to-Asset Ratio | ≤ 110% |

| Current Ratio | ≥ 1.5 |

4. Earnings growth: Positive trends

You wouldn’t invest in a bakery if the bread’s always stale, right? The same goes for companies. Graham encourages investors to check a company’s earnings over the last five years. If the earnings per share (EPS) have grown by at least one-third, you’ve likely found a company that knows how to bake profits, and its ovens are still hot!

5. Price-to-earnings ratio: Valuation check

Ever feel like you’ve found the best deal during a sale? The price-to-earnings (P/E) ratio is the stock market’s way of showing whether a stock is on sale. Graham recommended investing in companies with a P/E ratio of 9.0 or less—stocks trading at this level might just be the bargains that others are missing. Think of it as snagging a designer outfit at a thrift store price.

6. Price-to-book ratio: Hidden value

Imagine buying a house for less than the value of its land and materials. That’s essentially what you’re doing when you invest in companies with a price-to-book (P/B) ratio below 1.2. This means the stock is trading for less than its actual assets are worth. It’s like buying a house for half its construction cost—a deal too good to pass up!

7. Dividend payments: Income during the wait

Waiting for the market to recognize a stock’s true value can take time. To offset this, Graham advised investing in companies that pay dividends. This generates income while waiting and demonstrates the company’s financial health.

| Key Metric | Graham’s Benchmark |

|---|---|

| P/E Ratio | ≤ 9.0 |

| P/B Ratio | ≤ 1.2 |

| Dividend Payments | Consistent |

- P/E Ratio ≤ 9.0:The Price-to-Earnings (P/E) ratio should be 9.0 or lower. This means Graham looked for stocks where the price was no more than 9 times the company's earnings. A lower P/E ratio suggests the stock might be undervalued relative to its earnings.

- P/B Ratio ≤ 1.2:The Price-to-Book (P/B) ratio should be 1.2 or lower. This means the stock's market price should be no more than 1.2 times the company's book value per share. A P/B ratio below 1.2 indicates that the stock might be trading at a price lower than the company's net asset value, potentially signalling an undervalued stock.

- Dividend Payments: Consistent: Graham favored companies that paid consistent dividends. Regular dividend payments can indicate financial stability and provide income to investors while they wait for the stock price to increase.

These benchmarks were part of Graham's strategy to identify stocks that were potentially undervalued by the market, offering a margin of safety for investors.

The magic of Graham’s "Margin of safety"

Graham's golden rule was all about leaving room for error. Imagine driving with a safety buffer between your car and the one in front—you’re protected in case they suddenly brake. That’s the essence of Graham’s “margin of safety.” He believed in buying stocks at a significant discount to their intrinsic value, giving you protection from market downturns while keeping upside potential intact.

Why patience and discipline pay off

Let’s face it—value investing isn't for the impatient. It’s like planting a tree and waiting for it to bear fruit. You need patience, discipline, and the ability to ignore short-term noise. Graham’s principles give you a map, but the journey requires you to stick to the path, even when the winds change.

Practical application and modern adaptations

While Graham's principles remain foundational, modern investors have adapted them to suit today's market conditions:

Screening tools

Many investors now use computerized screening tools to quickly filter stocks based on Graham's criteria. These tools can scan thousands of stocks in seconds, identifying potential value investments that meet Graham's quantitative requirements.

Sector-specific adjustments

Graham's criteria may need adjustments for certain sectors. For example:

- Technology stocks: Often trade at higher P/E and P/B ratios due to their growth potential and intangible assets. Investors might use higher thresholds for these metrics when evaluating tech companies.

- Financial stocks: Typically have higher debt levels, so the debt-to-asset ratio criterion may need to be relaxed.

Qualitative factors

While Graham focused heavily on quantitative metrics, modern value investors often incorporate qualitative factors:

- Competitive advantage: Assessing a company's moat or sustainable competitive edge.

- Management quality: Evaluating the track record and integrity of company leadership.

- Industry trends: Considering long-term industry dynamics that could affect the company's future.

Global application

Graham's principles can be applied globally, but investors should consider:

- Country-specific risks: Political stability, currency fluctuations, and regulatory environments.

- Accounting standards: Differences in financial reporting across countries may require adjustments to Graham's metrics.

Combining with other strategies

Some investors blend Graham's approach with other strategies:

- Growth at a Reasonable Price (GARP): Seeking companies with both value characteristics and growth potential.

- Quality investing: Focusing on high-quality companies that meet some, but not all, of Graham's strict value criteria.

Graham’s enduring legacy

Benjamin Graham’s seven criteria for finding undervalued stocks have proven effective over time. By using these principles, investors can confidently navigate the stock market and find companies with strong fundamentals and growth potential. While the process can be challenging, investors who follow Graham’s wisdom with patience and discipline are more likely to achieve long-term success in value investing.

Many retail investors have made mistakes that can’t be corrected due to boarding hype trains and watching other investors without doing their due diligence. While value investing, the risk is lower by default as it is a more informed way to invest.

Frequently asked questions on Benjamin Graham's value investing criteria

Value investing is an investment strategy that focuses on identifying and purchasing stocks that are trading below their intrinsic value. It's important because it allows investors to potentially profit from market inefficiencies and reduce risk by buying stocks with a "margin of safety."

Benjamin Graham's approach to value investing has proven effective over time, helping investors make informed decisions based on fundamental analysis rather than market sentiment

While Graham's principles remain relevant, you may need to adapt them to modern market conditions. Use stock screening tools to filter companies based on Graham's metrics, but consider adjusting thresholds for certain sectors like technology.

Additionally, incorporate qualitative factors such as competitive advantage and management quality into your analysis. Remember that patience is key – value investing is a long-term strategy.

The "margin of safety" is a core concept in Graham's investment philosophy. It refers to buying stocks at a significant discount to their intrinsic value, providing a buffer against potential market downturns or errors in analysis. This approach is crucial because it helps protect your investment from unforeseen negative events while maintaining upside potential. Think of it as a safety net for your investments.

Yes, Graham's criteria remain effective, but they should be used as a starting point rather than strict rules. Many successful investors, including Warren Buffett (Graham's student), have adapted these principles for modern markets.

While the specific numbers may need adjustment, the underlying concepts of seeking financial stability, manageable debt, consistent earnings growth, and attractive valuation ratios are still valuable for identifying potentially undervalued stocks.

Disclaimer: This content is for informational purposes only and not financial advice. Always conduct your own research before investing.