Contents

When tension fuels opportunity: A summer in the US stock market

2 minutes read

15 July 2025

The sun rose on Wall Street this week, but it shone with a nervous, watchful glow. Traders tapped away at terminals, eyes darting between headlines about President Trump’s new tariffs and the promise—and peril—of the US inflation report. Amidst it all, the echoes of last quarter’s gains still reverberated. Could America’s stock market keep its cool as a swirl of global uncertainty, tech drama, and bank earnings converged in real time?

Banks find their moment in the spotlight

The air buzzed as the Q2 results for US banking titans—JPMorgan, Citigroup, and Wells Fargo—landed before the opening bell. Each report felt less like a victory lap and more like a stress test. Investors, fresh off a rally that saw bank shares soar nearly 18% year-to-date, wondered if the momentum could possibly last.

“Even with tariff threats and market wobbles, Wall Street’s heavyweights have stayed surprisingly resilient,” noted Ebrahim Poonawala, a Bank of America analyst. He warned, however, “Earnings season may represent a breather for the group. The easy gains have likely been priced in”.

The numbers told their own tale. Analysts expected a dip in JPMorgan’s revenue—down more than 12%—while Citigroup and Wells Fargo eyed modest growth in earnings per share. Yet, the real buzz was about trading revenue. Mollie Devine of Coalition Greenwich offered perspective: “Equity trading outperformed other asset classes, with projected revenue growth of 18% in Q2… Their responsiveness to volatility made them key revenue drivers”.

That volatility? Much of it was spurred by tariffs announced from the White House. As one senior Wall Street executive put it, “The tariff-induced environment led to a broad derisking of portfolios—a rush for liquidity we haven’t seen since the pandemic.” In the chaos, banks stood ready, market-makers offering lifelines as bonds, stocks and currencies all saw wild swings.

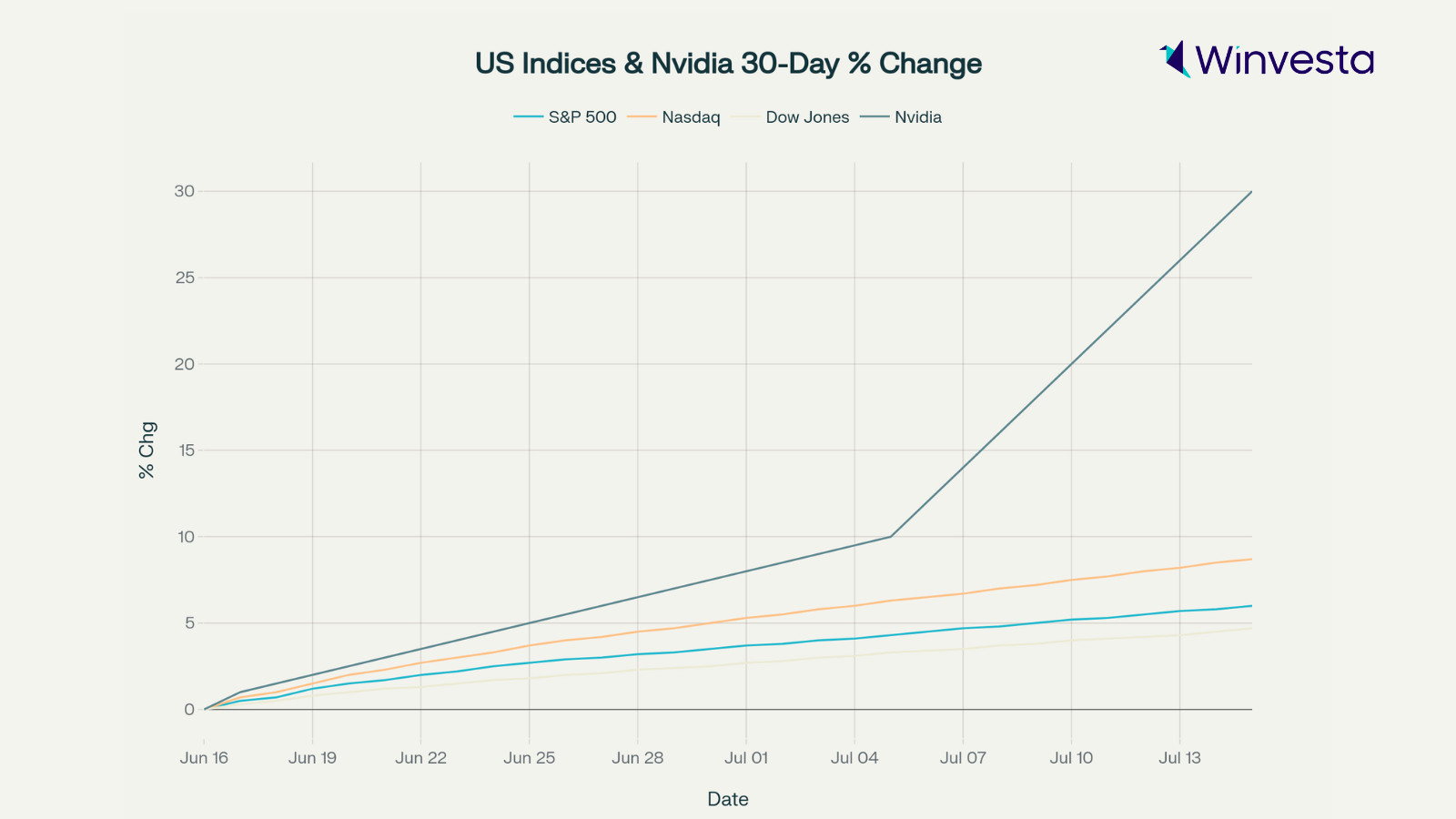

AI chips, tariff chills, and tech’s relentless drive

Meanwhile, the Nasdaq surged ahead, starring a familiar headline act: artificial intelligence stocks. Leading the charge was Nvidia. Just days after US officials cleared the way for renewed AI chip sales to China, demand for Nvidia’s hardware rocketed. “Chinese firms are scrambling to buy Nvidia’s H20 AI chips,” reported Reuters, citing company insiders. CEO Jensen Huang described China as “a critical market for Nvidia’s growth” and stated the company would soon resume deliveries, viewing this as “a real opportunity to expand global reach even amid regulatory headwinds”.

On the floor, traders cheered as Nvidia shares jumped, setting the tone for tech optimism. This validation of AI’s global influence even in uncertain climates led analysts at BlackRock to write: “Policy-driven volatility is pressuring growth, but we see artificial intelligence supporting corporate earnings… U.S. valuations are backed by stronger earnings and profitability relative to other developed markets”.

But, for all the bullishness, a watchful caution lingered. The Consumer Price Index data loomed, and tariffs on European and Mexican goods threatened to feed the inflation beast. Investors wondered aloud whether the president’s threats were tactics or the start of far-reaching consequences for global trade.

As stories unfolded—banks adapting to volatility, tech doubling down on chips, and tariffs reshaping global flows—market participants clung to every twist. Liz Ann Sonders of Charles Schwab summed up the prevailing attitude: “Markets don’t like uncertainty, but they love a compelling story. Right now, Wall Street has both in abundance”.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.