Contents

Wall Street’s winning streak: Optimism, tech, and the Fed fuel a summer rally

2 minutes read

27 June 2025

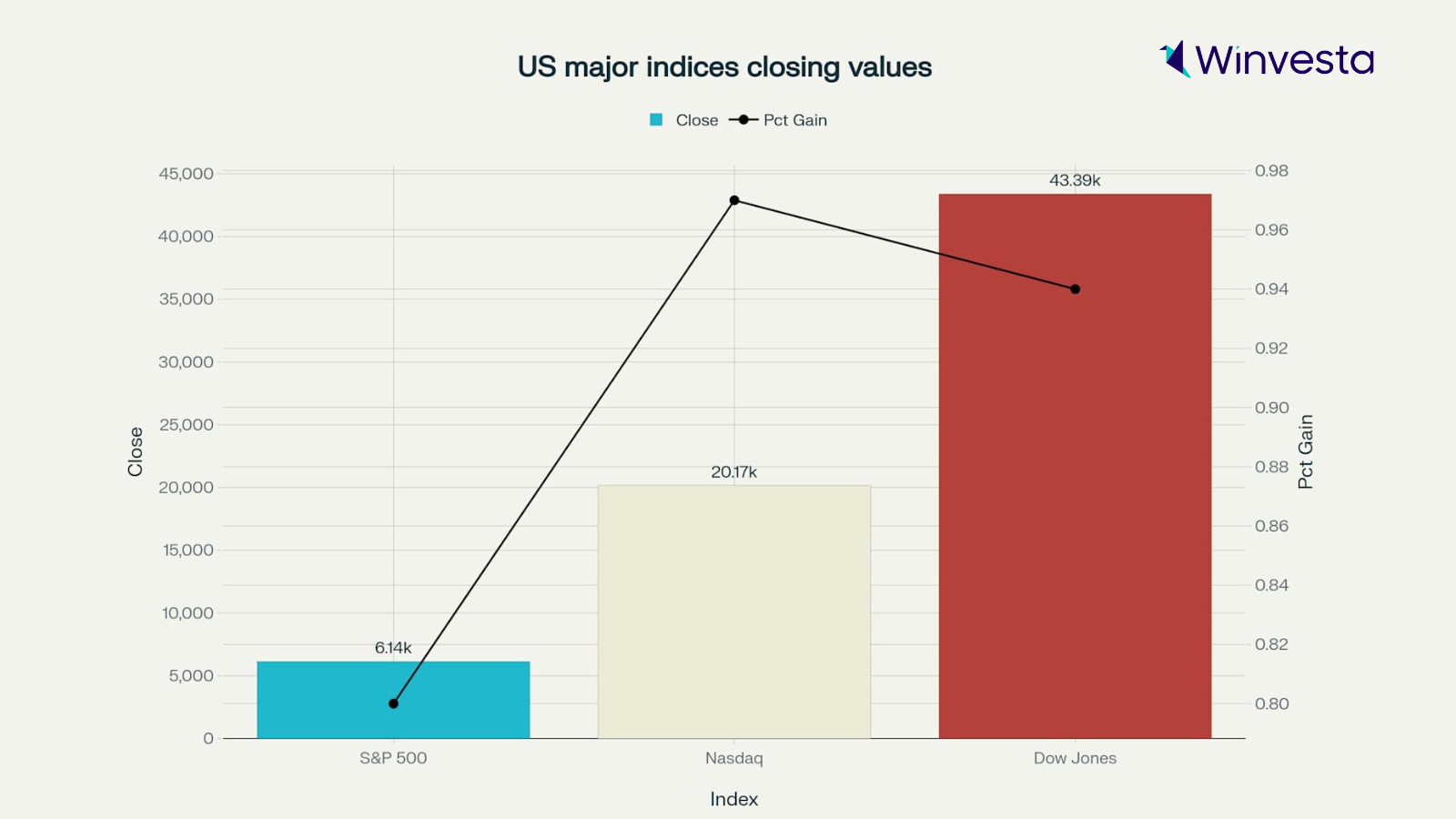

There’s a hum in the air on Wall Street this week—a sense that, after months of uncertainty, the tide is turning. The S&P 500 and Nasdaq have surged towards record highs, powered by a blend of optimism, resilience, and a dash of hope that the Federal Reserve might soon loosen its grip on interest rates. But behind the numbers, a story is unfolding—one of shifting sentiment, sector standouts, and the ever-present shadow of global events.

The Fed’s pivot: Why investors are cheering

It started with a whisper from the Federal Reserve. Recent comments from Fed officials hinted at a softer stance, with concerns about slowing growth and tighter credit conditions taking centre stage. Markets, always eager for clues, quickly priced in the possibility of up to three rate cuts before the year’s end. For investors, this was the green light they’d been waiting for.

Thursday’s economic data only added fuel to the fire. Weekly jobless claims edged up, suggesting the labour market is cooling just enough to give the Fed breathing room. The final revision of first-quarter GDP showed growth at 1.4%—not too hot, not too cold. As Megan Thompson, Chief Market Strategist at Arcadia Financial, put it: “This is the kind of data that gives the Fed room to pivot. We’re not seeing runaway inflation anymore, but we’re also not in recession territory. The Fed has the flexibility to lower rates without the market panicking.”

The bond market responded in kind. The yield on the 10-year Treasury note dipped below 4.20%, signalling growing confidence that lower rates are on the horizon. For equities—especially those in tech and other interest-sensitive sectors—this was a welcome boost.

Tech leads the charge, but risks remain

If the Fed is the wind in Wall Street’s sails, technology stocks are the engine. The Nasdaq outperformed, rising 1% on Thursday, with AI and semiconductor giants like Nvidia and Broadcom posting strong gains. Even Tesla, after a rocky spring, rebounded 10% this week following the successful launch of its robotaxi service in Austin. The S&P 500 and Nasdaq are both up over 25% from their April lows, a remarkable turnaround after a bruising start to the year.

Yet, not every sector is basking in the glow. Consumer discretionary names like Campbell’s and Smith & Wesson have stumbled, while energy stocks lagged as oil prices fell. And while the mood is upbeat, some experts urge caution. Rob Ginsberg of Wolfe Research notes, “The S&P 500’s resilience, despite macro and geopolitical challenges, suggests potential for a run at record highs.”

But Venu Krishna at Barclays warns that renewed Middle East tensions could quickly spark volatility, especially with volatility control funds ramping up equity exposure.

As the week closes, all eyes turn to Friday’s inflation data. If the numbers play along, the rally could roll on. But with fiscal policy uncertainties and global risks lurking in the background, investors know the story is far from over.

For now, Wall Street is enjoying its moment in the sun—buoyed by the promise of lower rates, the power of technology, and the hope that this time, the good news might just stick.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.