AI memory crisis: How chip shortages threaten tech profits and growth

The artificial intelligence boom that sent technology stocks soaring over the past eighteen months now faces an unexpected obstacle that could reshape investment strategies across the sector. When Elon Musk and Tim Cook start sounding alarm bells simultaneously, investors ought to pay attention. Both executives recently warned that a severe shortage of memory chips threatens to constrain AI development, drive up costs across the technology ecosystem, and potentially derail the ambitious expansion plans that have justified sky-high valuations for AI-dependent companies. For retail investors holding positions in everything from data centre operators to laptop manufacturers, this emerging crisis represents far more than a temporary supply chain hiccup.

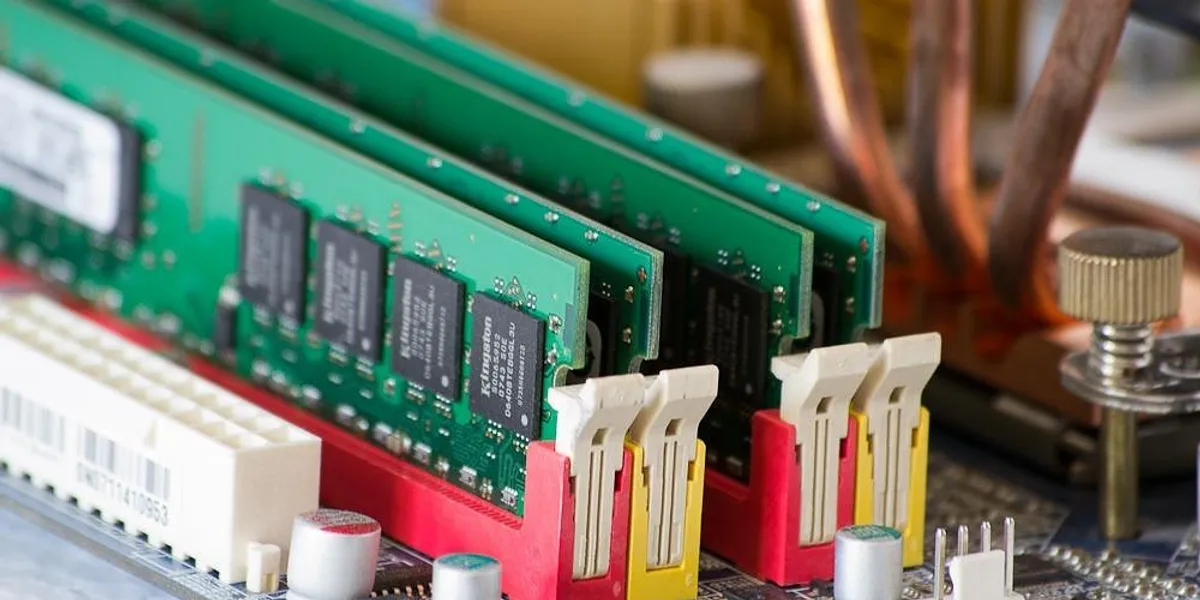

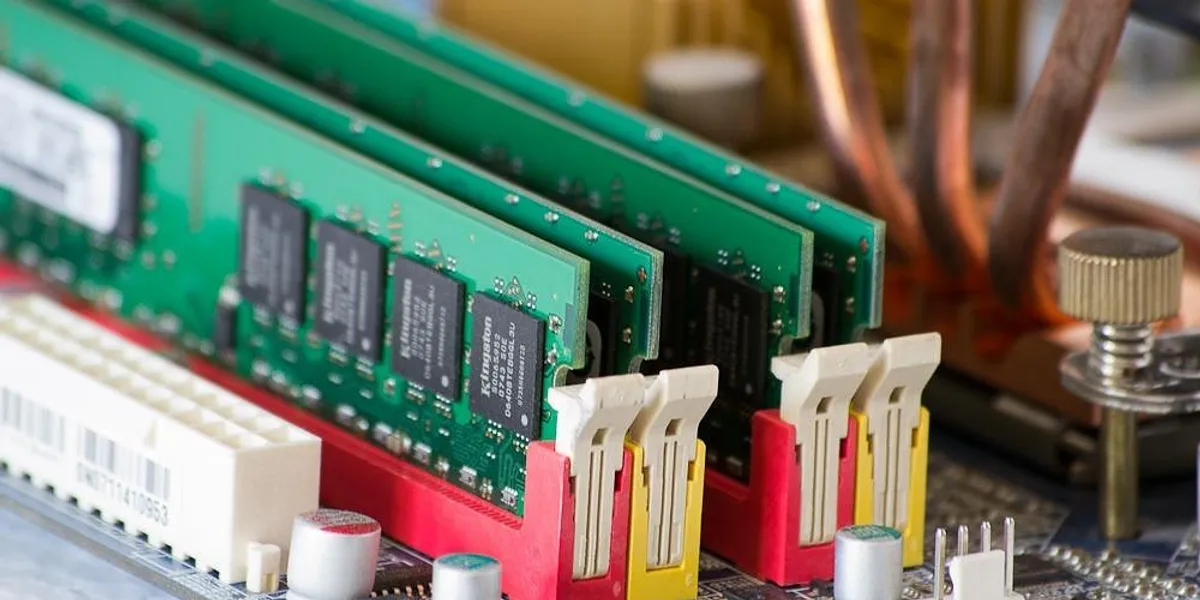

The shortage centres on high-bandwidth memory chips, particularly HBM3 variants, which are essential for training large language models and running AI workloads at scale. Unlike previous chip shortages that primarily affected consumer electronics, this crunch strikes at the heart of the AI infrastructure buildout that Wall Street has valued in the trillions of dollars. Companies including Microsoft, Amazon, and Alphabet have collectively announced plans to spend over 250 billion dollars on AI infrastructure through 2026, yet those ambitious timelines now appear increasingly optimistic as memory suppliers struggle to keep pace with demand that has exceeded even the most bullish forecasts. The situation has already begun to affect quarterly earnings, with several technology firms reporting margin compression due to elevated memory costs and delayed product launches, both attributed directly to component availability.

The root cause extends beyond simple supply-demand imbalances. Memory chip production requires extraordinarily complex manufacturing processes and specialised equipment that cannot be rapidly scaled. South Korean manufacturers Samsung and SK Hynix dominate the HBM market, controlling roughly 95 per cent of global production capacity, whilst Micron Technology represents the primary American competitor. This concentration creates bottlenecks that ripple through the entire technology sector. When AI chip leader Nvidia designs its next-generation processors, those chips remain useless without adequate memory to feed them data. Data centre operators cannot deploy purchased servers because memory modules arrive months late. Consumer device makers face difficult choices between accepting lower margins and passing on higher costs to customers in an already price-sensitive market.

Portfolio Implications Extend Beyond Semiconductor Stocks

Investors might assume memory shortages primarily affect semiconductor manufacturers, yet the financial consequences extend far beyond them. Companies across the technology sector face margin pressure as memory costs rise, with spot prices for certain HBM3 modules up more than 40 per cent since October 2025. Hyperscale cloud providers—the Amazons, Microsofts, and Googles of the world—confront difficult trade-offs between maintaining their AI development roadmaps and protecting profitability. Smaller AI startups face even starker realities, as limited memory availability increasingly favours established players with existing supplier relationships and deeper pockets to secure scarce inventory.

"We're witnessing a fundamental constraint on the AI buildout that markets have priced as nearly inevitable," says Rebecca Morrison, Chief Technology Analyst at Whitestone Research. "When companies cannot access the memory required to operationalise their AI investments, those billions in capital expenditures generate returns later than expected or potentially not at all."

This constraint is already materialising: SK Hynix has confirmed that its HBM capacity for 2026 is essentially sold out, while Micron's CEO has stated that the company's high-bandwidth memory is "fully booked" through 2026, leaving hyperscalers scrambling to secure allocation.

The shortage creates winners and losers that may surprise investors focused solely on AI adoption headlines. Memory manufacturers themselves obviously benefit from pricing power, with SK Hynix shares advancing 18 per cent year-to-date, partly on improved margin outlooks. However, companies positioned further down the value chain face headwinds. Personal computer manufacturers like Dell and HP report that memory costs now account for a larger share of total bill-of-materials expenses, squeezing gross margins in a segment already struggling with tepid consumer demand. Data centre equipment providers report revenue recognition is delayed as customers postpone orders until complete systems are available. Even software companies feel the pinch, as their cloud infrastructure partners scrutinise capacity allocations more carefully.

The smartphone sector illustrates how quickly shortages affect consumer-facing businesses. Apple's premium iPhone models incorporate increasing amounts of memory to support on-device AI features that differentiate products in a mature market. As memory costs rise, Apple faces a familiar dilemma: absorb higher input costs or increase retail prices. Tim Cook's public comments about supply constraints signal that even Apple's legendary supply chain management cannot fully insulate the company from market realities. Android manufacturers with limited pricing power find themselves in even more precarious positions, potentially forced to delay AI feature rollouts or scale back memory specifications, which could compromise the user experience.

Strategic Responses Reshape Competitive Dynamics

The crisis accelerates strategic shifts that carry long-term implications for investors. Technology giants increasingly pursue vertical integration to secure supply, with Amazon's investments in custom AI chip design partly motivated by a desire to reduce dependence on external memory suppliers. Microsoft has explored partnerships with memory manufacturers that guarantee capacity in exchange for long-term purchase commitments, effectively locking in supply whilst competitors scramble. These moves favour cash-rich incumbents over smaller innovators, potentially slowing the competitive dynamics that have driven rapid AI advancement.

"Memory availability becomes a competitive moat in ways we haven't seen since the early 2000s," observes James Chen, Senior Portfolio Manager at Cascade Capital Management. "Companies with secured supply chains can maintain development velocity whilst competitors stall, creating divergence in capabilities that markets will reward."

This dynamic is already reshaping procurement strategies: hyperscalers are signing multi-year supply agreements that effectively lock in significant portions of global DRAM and NAND output, with suppliers signalling they will prioritise customers who commit to longer-term, higher-volume relationships.

Manufacturing expansion offers hope but requires patience. SK Hynix and Samsung have announced capacity increases, yet new fabrication facilities require 18 to 24 months to reach full production. Micron's planned investments in American manufacturing facilities support long-term supply diversification but won't materially impact availability until late 2027 at the earliest. Meanwhile, demand continues to accelerate as AI applications expand beyond initial use cases, suggesting the supply-demand imbalance will persist well into 2028 under current trajectories.

For retail investors, the memory shortage demands portfolio reassessment beyond simply buying semiconductor stocks. Companies with strong supplier relationships, diversified memory sources, or sufficient cash to secure inventory deserve premium valuations relative to competitors lacking those advantages. Investors should scrutinise earnings calls for commentary about component availability and margin pressure, as management teams often signal problems quarters before they fully materialise in financial results. The AI revolution remains real, but its timeline and profitability may prove more modest than the euphoric valuations of 2024 and 2025 suggested. Those willing to favour companies that navigate constraints successfully over those chasing every AI stock indiscriminately are better positioned as this shortage reshapes the competitive landscape through 2026 and beyond.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs

The artificial intelligence boom that sent technology stocks soaring over the past eighteen months now faces an unexpected obstacle that could reshape investment strategies across the sector. When Elon Musk and Tim Cook start sounding alarm bells simultaneously, investors ought to pay attention. Both executives recently warned that a severe shortage of memory chips threatens to constrain AI development, drive up costs across the technology ecosystem, and potentially derail the ambitious expansion plans that have justified sky-high valuations for AI-dependent companies. For retail investors holding positions in everything from data centre operators to laptop manufacturers, this emerging crisis represents far more than a temporary supply chain hiccup.

The shortage centres on high-bandwidth memory chips, particularly HBM3 variants, which are essential for training large language models and running AI workloads at scale. Unlike previous chip shortages that primarily affected consumer electronics, this crunch strikes at the heart of the AI infrastructure buildout that Wall Street has valued in the trillions of dollars. Companies including Microsoft, Amazon, and Alphabet have collectively announced plans to spend over 250 billion dollars on AI infrastructure through 2026, yet those ambitious timelines now appear increasingly optimistic as memory suppliers struggle to keep pace with demand that has exceeded even the most bullish forecasts. The situation has already begun to affect quarterly earnings, with several technology firms reporting margin compression due to elevated memory costs and delayed product launches, both attributed directly to component availability.

The root cause extends beyond simple supply-demand imbalances. Memory chip production requires extraordinarily complex manufacturing processes and specialised equipment that cannot be rapidly scaled. South Korean manufacturers Samsung and SK Hynix dominate the HBM market, controlling roughly 95 per cent of global production capacity, whilst Micron Technology represents the primary American competitor. This concentration creates bottlenecks that ripple through the entire technology sector. When AI chip leader Nvidia designs its next-generation processors, those chips remain useless without adequate memory to feed them data. Data centre operators cannot deploy purchased servers because memory modules arrive months late. Consumer device makers face difficult choices between accepting lower margins and passing on higher costs to customers in an already price-sensitive market.

Portfolio Implications Extend Beyond Semiconductor Stocks

Investors might assume memory shortages primarily affect semiconductor manufacturers, yet the financial consequences extend far beyond them. Companies across the technology sector face margin pressure as memory costs rise, with spot prices for certain HBM3 modules up more than 40 per cent since October 2025. Hyperscale cloud providers—the Amazons, Microsofts, and Googles of the world—confront difficult trade-offs between maintaining their AI development roadmaps and protecting profitability. Smaller AI startups face even starker realities, as limited memory availability increasingly favours established players with existing supplier relationships and deeper pockets to secure scarce inventory.

"We're witnessing a fundamental constraint on the AI buildout that markets have priced as nearly inevitable," says Rebecca Morrison, Chief Technology Analyst at Whitestone Research. "When companies cannot access the memory required to operationalise their AI investments, those billions in capital expenditures generate returns later than expected or potentially not at all."

This constraint is already materialising: SK Hynix has confirmed that its HBM capacity for 2026 is essentially sold out, while Micron's CEO has stated that the company's high-bandwidth memory is "fully booked" through 2026, leaving hyperscalers scrambling to secure allocation.

The shortage creates winners and losers that may surprise investors focused solely on AI adoption headlines. Memory manufacturers themselves obviously benefit from pricing power, with SK Hynix shares advancing 18 per cent year-to-date, partly on improved margin outlooks. However, companies positioned further down the value chain face headwinds. Personal computer manufacturers like Dell and HP report that memory costs now account for a larger share of total bill-of-materials expenses, squeezing gross margins in a segment already struggling with tepid consumer demand. Data centre equipment providers report revenue recognition is delayed as customers postpone orders until complete systems are available. Even software companies feel the pinch, as their cloud infrastructure partners scrutinise capacity allocations more carefully.

The smartphone sector illustrates how quickly shortages affect consumer-facing businesses. Apple's premium iPhone models incorporate increasing amounts of memory to support on-device AI features that differentiate products in a mature market. As memory costs rise, Apple faces a familiar dilemma: absorb higher input costs or increase retail prices. Tim Cook's public comments about supply constraints signal that even Apple's legendary supply chain management cannot fully insulate the company from market realities. Android manufacturers with limited pricing power find themselves in even more precarious positions, potentially forced to delay AI feature rollouts or scale back memory specifications, which could compromise the user experience.

Strategic Responses Reshape Competitive Dynamics

The crisis accelerates strategic shifts that carry long-term implications for investors. Technology giants increasingly pursue vertical integration to secure supply, with Amazon's investments in custom AI chip design partly motivated by a desire to reduce dependence on external memory suppliers. Microsoft has explored partnerships with memory manufacturers that guarantee capacity in exchange for long-term purchase commitments, effectively locking in supply whilst competitors scramble. These moves favour cash-rich incumbents over smaller innovators, potentially slowing the competitive dynamics that have driven rapid AI advancement.

"Memory availability becomes a competitive moat in ways we haven't seen since the early 2000s," observes James Chen, Senior Portfolio Manager at Cascade Capital Management. "Companies with secured supply chains can maintain development velocity whilst competitors stall, creating divergence in capabilities that markets will reward."

This dynamic is already reshaping procurement strategies: hyperscalers are signing multi-year supply agreements that effectively lock in significant portions of global DRAM and NAND output, with suppliers signalling they will prioritise customers who commit to longer-term, higher-volume relationships.

Manufacturing expansion offers hope but requires patience. SK Hynix and Samsung have announced capacity increases, yet new fabrication facilities require 18 to 24 months to reach full production. Micron's planned investments in American manufacturing facilities support long-term supply diversification but won't materially impact availability until late 2027 at the earliest. Meanwhile, demand continues to accelerate as AI applications expand beyond initial use cases, suggesting the supply-demand imbalance will persist well into 2028 under current trajectories.

For retail investors, the memory shortage demands portfolio reassessment beyond simply buying semiconductor stocks. Companies with strong supplier relationships, diversified memory sources, or sufficient cash to secure inventory deserve premium valuations relative to competitors lacking those advantages. Investors should scrutinise earnings calls for commentary about component availability and margin pressure, as management teams often signal problems quarters before they fully materialise in financial results. The AI revolution remains real, but its timeline and profitability may prove more modest than the euphoric valuations of 2024 and 2025 suggested. Those willing to favour companies that navigate constraints successfully over those chasing every AI stock indiscriminately are better positioned as this shortage reshapes the competitive landscape through 2026 and beyond.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs