Contents

Riding the wave: How optimism and uncertainty are shaping today’s US stock market

2 minutes read

30 June 2025

The city is quiet, but anticipation is building. It’s Monday morning in New York, and while the trading floor still waits for the opening bell, all eyes are already on the numbers flashing across futures screens. Wall Street’s main indices—S&P 500, Nasdaq, and Dow Jones—haven’t started their day, but their futures are already pointing higher, hinting at another chapter in this year’s remarkable rally. After a weekend of global headlines and shifting sentiment, investors are poised for what could be another record-breaking session. The mood is one of cautious optimism, as traders weigh fresh hopes for trade deals, the prospect of interest rate cuts, and the steady hum of economic data set to shape the week ahead.

The power of positive sentiment

The mood on Wall Street is hard to ignore. Liz Young Thomas, SoFi’s head of investment strategy, captured it best: “The scientific way that we said this in the outlook is that ‘the vibes are positive.’” She added, “We would expect the sentiment — that positive sentiment — to continue into 2025”.

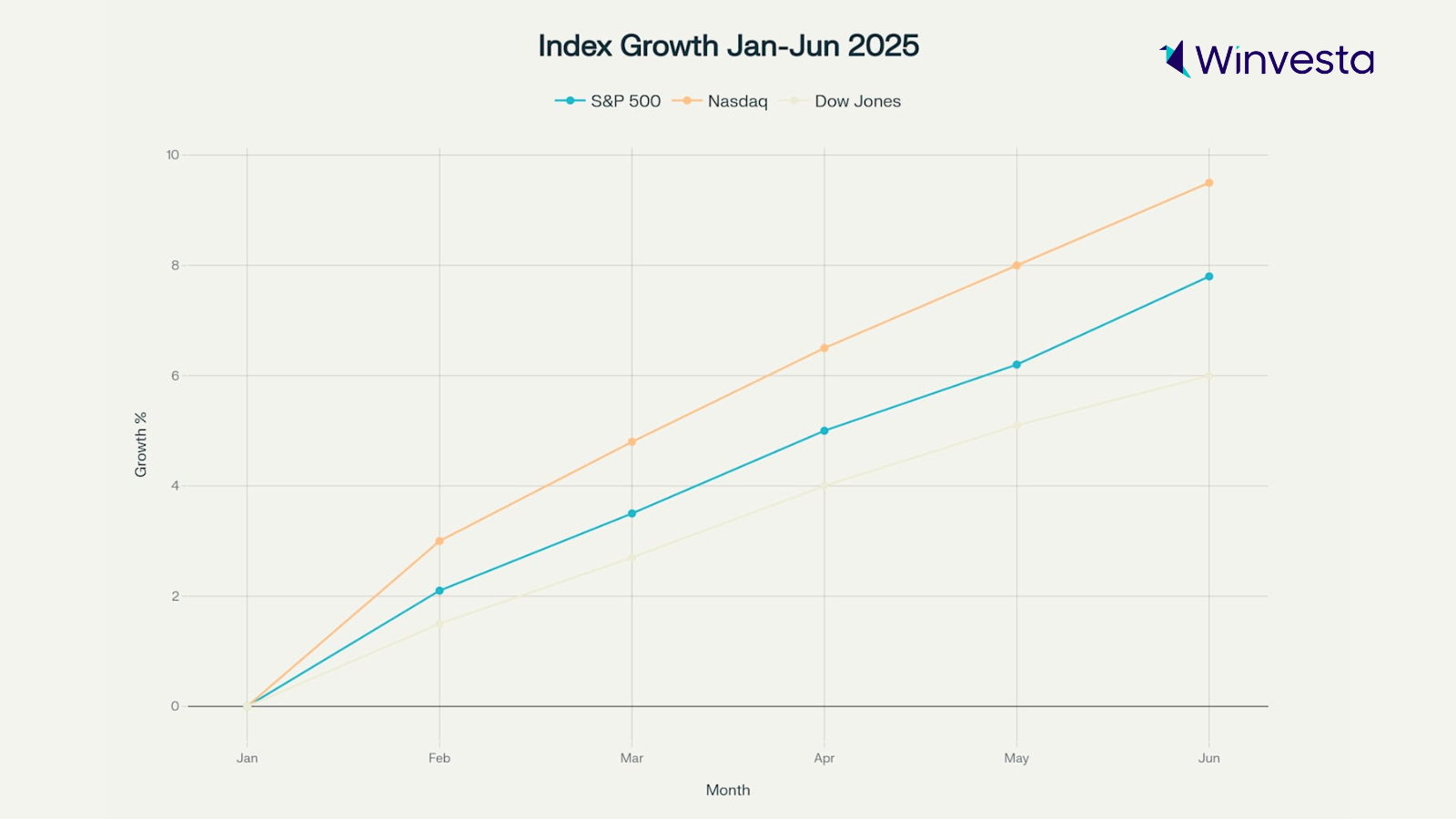

This optimism isn’t just a feeling; it’s reflected in the numbers. The S&P 500 has surged by more than 20% for the fourth time in six years, a feat few predicted at the start of 2024. The Nasdaq and Dow have followed suit, buoyed by strong earnings and a belief that the path of least resistance is, for now, upwards.

John Stoltzfus, chief investment strategist at Oppenheimer, is among the most bullish voices, projecting a year-end S&P 500 target of 7,100, representing a 17% gain from current levels. “Economic resilience and market momentum should carry into the new year,” Stoltzfus wrote in a note to clients. Even Jason Draho, UBS’s head of asset allocation, sees little short-term downside: “With risks either not materialising or investors not paying much attention to them as the holidays approach, the path of least resistance is for the markets to keep rallying”.

But not everyone is convinced the good times will last. Sri Kumar of Sriumar Global Strategies warns, “The various macro factors that I’m observing indicate that this situation cannot persist.” He points to simmering geopolitical risks and the lingering effects of tariffs as reasons for caution.

Navigating uncertainty: What lies beneath the rally

While the headlines celebrate record highs, seasoned observers are watching the undercurrents. Howard Lutnick, CEO of Cantor Fitzgerald, urges investors to keep their expectations in check. “Zero interest rates, perceived as normal by younger generations, are not the historical norm,” he said in a recent interview. Lutnick believes that maintaining the current interest rate of around 5% is reasonable, even with inflationary pressures and a $34 trillion US deficit. “Stability is poised to stimulate capital markets activity and create opportunities for growth,” he added.

Meanwhile, the market’s resilience has been tested by global events. Tensions in the Middle East have eased following a ceasefire, and trade negotiations with China have shown signs of progress. Yet, as Liz Young Thomas cautions, “When, a lot of times, consensus is all in one corner, that’s when you want to get sceptical of consensus. But it is difficult to paint a bad picture with the current data”.

For now, the rally continues, driven by optimism and a sense that the market can defy gravity a little longer. But as history shows, sentiment can shift quickly. Investors would do well to enjoy the ride—while keeping one eye on the exit.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.