Contents

Record highs driven by optimism and trade relief

2 minutes read

01 July 2025

The opening bell on Wall Street rang in July with a sense of anticipation. Traders leaned forward, eyes fixed on the screens, as the S&P 500 and Nasdaq soared to new heights. For many, the rally felt like a breath of fresh air after months of market jitters and tariff turmoil. But behind the numbers lies a story of resilience, shifting sentiment, and the ever-present dance between policy and profit.

As the sun climbed over Manhattan, the mood on trading floors was noticeably lighter. Just weeks ago, the market had been battered by headlines: trade wars, tariff threats, and whispers of a potential economic slowdown. Yet, as Canada unexpectedly withdrew its digital services tax—sidestepping a major clash with US tech giants—investors exhaled. “What has allowed this almost full recovery in the stock market hinges on the negotiations that are now under way,” explained Angelo Kourkafas, senior investment strategist at Edward Jones. With trade tensions easing, the market’s tone shifted from caution to cautious optimism.

Tech leads the charge as policy clouds lift

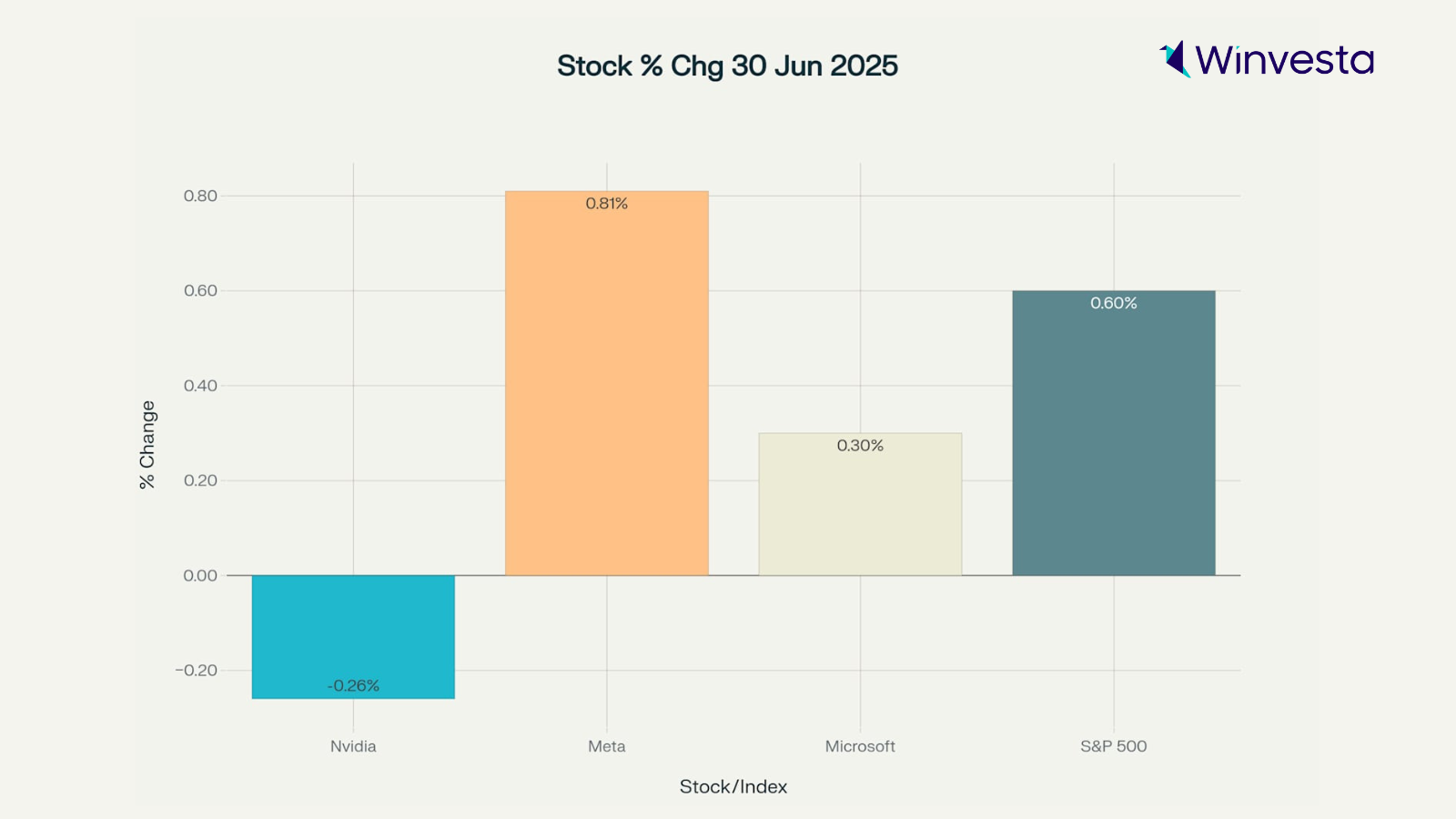

The rally wasn’t just about headlines; it was about leadership. Tech giants, once targets of international tax threats, powered the surge. Nvidia and Meta both closed at record highs, while Microsoft flirted with its own peak. The S&P 500 climbed 0.6%, and the Nasdaq followed suit, both setting new records. The Dow Jones, too, joined the party, rising 0.7% as blue chips found favour again.

But it wasn’t just tech in the spotlight. Retailers like Nike and Lululemon Athletica posted gains after upbeat forecasts, reflecting renewed consumer confidence. Even as gold miners slipped, the broader market’s momentum was undeniable. “Historically, July has been one of the strongest months for US equities,” noted a market analyst on Moomoo, pointing out that the S&P 500 has averaged a 1.7% gain in July since 1928. This year, that seasonal strength is bolstered by hopes of a Federal Reserve rate cut—a move that could make borrowing cheaper and stocks even more attractive.

Optimism meets reality: What’s next for investors?

Yet, beneath the surface, challenges remain. The S&P’s price-to-earnings ratio now sits above 23, signalling that stocks are expensive relative to expected profits. Some experts caution that if Congress fails to pass key domestic policy bills or if trade talks falter, the celebration could be short-lived. “Stocks confront numerous hurdles in the forthcoming weeks and months,” warned a recent CNN analysis, highlighting the risk of renewed tariffs and geopolitical tensions in the Middle East.

Still, the prevailing mood is one of resilience. Volatility, which spiked during April’s “Liberation Day” tariff announcement, has since moderated. Investors are watching closely for upcoming economic data, including the jobs report and manufacturing indices, which could shape the Federal Reserve’s next move. UBS Global Wealth Management recently raised its year-end S&P 500 target to 6,200, citing reduced trade uncertainty and a dovish Fed outlook.

As Wall Street heads into the heart of summer, the story is no longer just about surviving shocks—it’s about seizing opportunities. The market’s rally may face tests ahead, but for now, the bulls are in control, and optimism is the order of the day.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.