Contents

Jackson Hole whispers and tech thunder: How Wall Street woke up in August

2 minutes read

25 August 2025

The late-summer air in Wyoming buzzed with anticipation last Friday. Investors clung to every word from Federal Reserve Chair Jerome Powell at Jackson Hole, and when Powell hinted at the possibility of an interest rate cut, Wall Street did more than just listen—it jumped to its feet.

"Downside risks to employment are increasing," Powell announced. "The prevailing outlook and the changing balance of risks may necessitate a reevaluation of our policy stance," he added, as heads of global central banks nodded thoughtfully. Traders heard opportunity. The Dow Jones closed at a record high, up over 800 points, marking its largest single-day rise this year.

Heather Long, chief economist at Navy Federal Credit Union, summed up the mood: "That's about as clear cut as Powell can get that he has shifted his view since July and is leaning toward a cut in September". Hayes from Great Capital LLC echoed the optimism: "Chair Powell was more dovish than anticipated. He has set the stage for action in September".

In New York trading rooms, excitement replaced anxiety. Regional banks and homebuilders soared, up 4-8% in a single burst. These are companies that thrive when borrowing becomes cheaper. Meanwhile, tech stocks drew the most attention, and for good reason.

Tech earnings ignite optimism

While Powell's words set the stage, it was the “Magnificent Seven”, America's tech giants, that turned excitement into fireworks. They added an eye-popping $370 billion in value during the rally, showing just how much investors expect from companies riding the artificial intelligence wave.

Zoom kicked things off, reporting second-quarter profits far above expectations, sending the stock surging. But all eyes soon turned to Nvidia, the market’s AI darling. This Wednesday’s earnings report is set to answer one looming question: Can Nvidia keep up its rocket-fuel growth despite trade restrictions and geopolitical uncertainty?

Wall Street analysts set the bar high. "Nvidia continues to lead the market in AI data centre GPUs, benefits from substantial spending by hyperscalers, and may surpass high expectations once more," said Wedbush analyst Dan Ives, who recently raised his price target to $210. Karee Venema from Kiplinger added, "Nvidia earnings are one of Wall Street's most anticipated events, thanks to accelerating demand for all things artificial intelligence". Hedge funds backed the optimism, buying 113 million shares in the last quarter alone.

As Nvidia prepares to announce, traders balance bullish hopes against caution. Export restrictions imposed by China could take a billion-dollar bite out of the quarter. Still, most experts believe AI will power further gains.

Earnings strength and market resilience

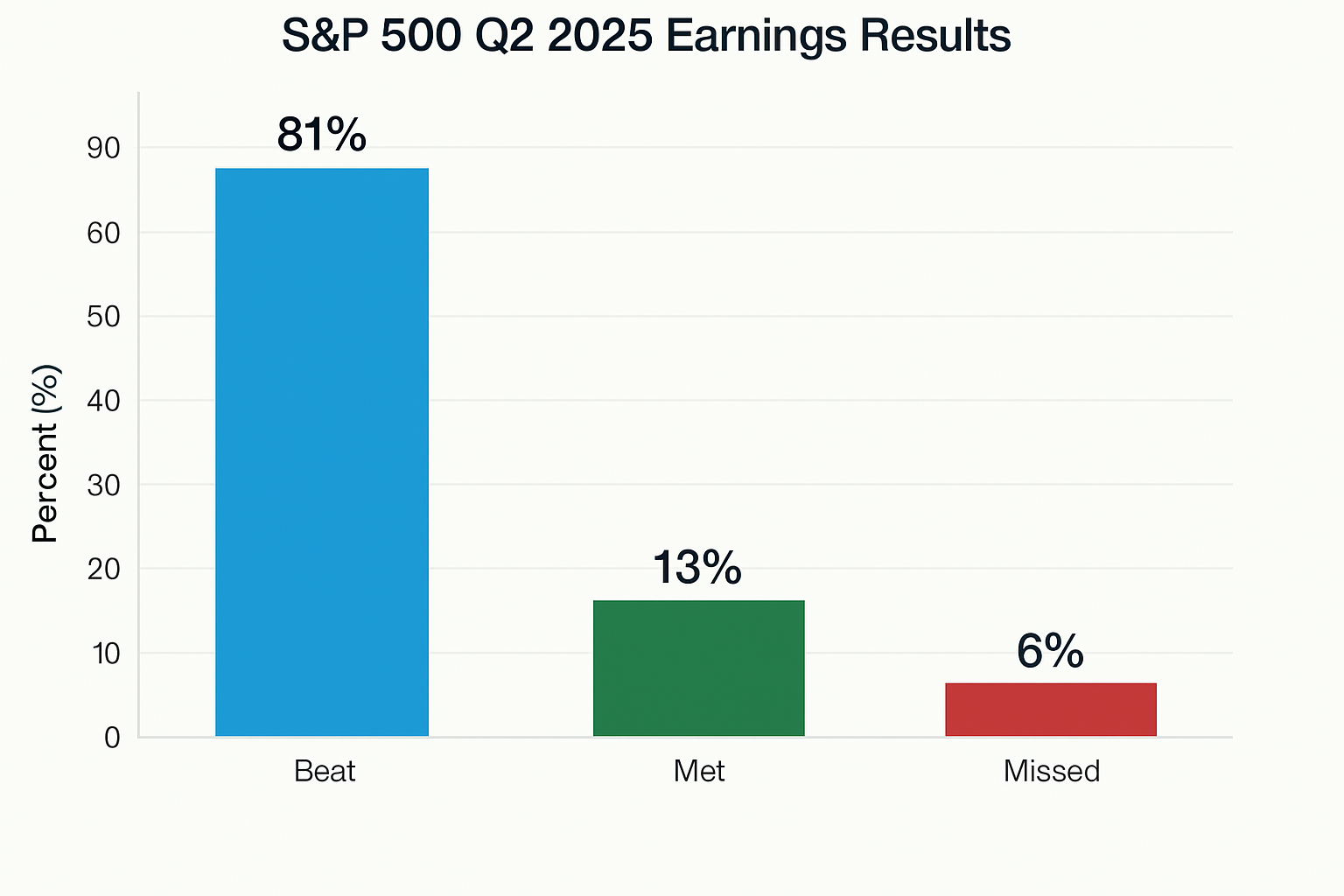

Corporate earnings fuelled much of this month’s optimism. Of the 435 S&P 500 companies reporting, 81% beat expectations, driving profits a robust 11.7% higher year-over-year. "Stocks continue to rise while inflation data has held steady, and corporate earnings have generally exceeded expectations," noted the investment team at Carnegie.

Yet, challenges lurk beneath the surface. President Trump’s tariff policies add new uncertainty, as do questions about fiscal sustainability and bond market signals. Bill Merz of U.S. Bank points out: "Fundamental factors like aggregate consumer spending and corporate earnings remain solid, allowing investors to look past potential tariff impacts for now".

The market's resilience is striking. After flirting with bear territory in April, US indices now sit close to all-time highs, with industrials, utilities and financials joining tech as top-performing sectors. "This cycle of margin expansion and top-line stability can extend further—particularly among high-quality businesses with pricing power," believes Dean Orrico, CEO of Middlefield Group.

As Jackson Hole’s echoes fade, and tech’s earnings headlines take centre stage, investors face a blend of optimism and risk. The market story for August: hope on the horizon, powered by dovish policy signals and the steady beat of corporate profits.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.