Investing in Overseas Real Estate from India - A Checklist

3 minutes read

Real Estate is the first name that pops up if an Indian investor is asked to pick an alternative investment other than equities. But the property market in India has faced trials and tribulations of its own over the last decade. Investors turned to other options like gold, fixed income, and commodities in a hunt for better yields and diversification. But have you ever considered investing in overseas real estate? Well, many Indians have certainly started giving that serious consideration. Higher yields and availability of fractional real estate have helped in driving the momentum towards international real estate.

Over the two Covid-19 waves in India spanning the last year and a half, Indians have chosen to invest in their second homes abroad. Attractive investment destinations include countries like Netherlands, Germany, USA, and Australia among others.

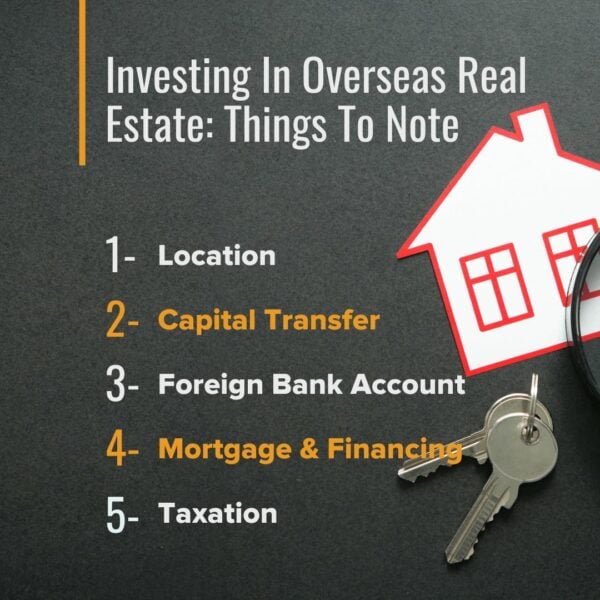

Investing In Overseas Real Estate From India: 5 Things to Keep in Mind

-

Location

Indians have invested actively in countries like the UK, US, Netherlands, Germany, UAE, and Australia among other destinations. These countries have a mature property investment market, provide easy remote management options, and clear ownership laws. This makes them a safer investment choice compared to developing countries and even the domestic property market.

While selecting a location, you should consider things like capital appreciation, rental yield, ease of purchase and maintenance, and fees like stamp duty on entry and exit. You may also want to consider other objectives. These could be visa by investment, vacation home, or place of retirement while making the selection.

-

Capital transfer

An Indian citizen can utilise the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India to invest in property abroad. The LRS permits free remittance of up to $250,000 per individual per financial year. However, if more than one person pools their remittance to purchase a property, then the concerned property should be in the name of all the members who have contributed to the remittance. You can also make remittances in the name of children, including minors.

For Example, let’s say – you, your spouse, and two other family members pooled their remittances to purchase a property in the UK. The property will now have to be named after all four and not one single person. (Source: RBI)

-

Foreign Bank Account

A foreign bank account is often necessary and prudent to have for a foreign real estate investment. You will need a bank account for proof of funds, transferring deposit and purchase amount, paying any duties, and handover expenses. After the purchase, having a foreign account helps in collecting rent and paying maintenance fees. In the future, if you wish to sell the property, you will again need an account to receive the proceeds and pay the selling expenses. Buying and maintaining an overseas property from India is difficult and expensive.

A Winvesta multi-currency account provides foreign currency accounts in 30+ currencies, enabling you to invest in real estate almost anywhere in the world. The account can be set up digitally in minutes. It is one of the most convenient and economical ways for Indians to get a foreign currency account.

-

Mortgage and Financing

“Cash is King!” – Truer words were never spoken when it comes to investing in properties, especially overseas. It is good to have the corpus available. Most banks are reluctant to approve loan applications to buy properties abroad. In case the borrower defaults on the payment, taking possession of that property becomes a difficult task for Indian lenders. Similarly foreign banks don’t provide mortgages to non-residents.

-

Taxation

While you buy / rent or lease properties overseas, you need to be aware of its own tax implications. The taxation laws will depend on your residency and the country of purchase. For example, let’s say as an Indian resident, you purchase a property overseas. In that case, the rent arising from the property will be taxable in India. However, if paid taxes overseas, you can claim a foreign tax credit in India (for most countries).

If you made substantial gains after investing in a property overseas and you plan to sell it off, the capital gains arising from the proceeds will also be taxable in India. The taxation laws from income, rental, or capital gains from a property held overseas are similar to properties held in India. Of course, you would wish to seek exemption on the investments you made, they will be available under Section 54 and 54F. However, that comes with its own set of riders. The exemptions will be applicable only if you reinvest the proceeds in a residential property in India. Many countries, including the UK, have favourable tax treatment for foreign investors, which would help reduce the overall tax burden.

In order to make these transactions easier, one can opt to open Multi-Currency Account with Winvesta. The MCA allows you to transact in over 30+ currencies across the world. So whether you buy, rent, sell or lease any property overseas, all your transactions can be carried out through this account. Your hub for global investments.

Ready to Start Investing in Foreign Real Estate?

Get a Winvesta Multi-Currency Account and start managing all your global investments from one place.

check outAll content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Winvesta is not a tax advisor. Tax treatment depends on your individual circumstances and may be subject to change in the future. You should take independent advice from a tax professional about how the taxation may apply to you, or independently research and verify, any information that you find in this article and wish to rely upon. Remember capital is at risk. Terms & Conditions apply.

Contributed by Swastik Nigam

He is the Founder & CEO of Winvesta. Before Winvesta, he was a Director at Deutsche Bank where he ran a multi-billion EUR global trading book