Contents

What are Fractional Shares?

2 minutes read

13 May 2024

A fractional share is less than a full share of an equity or ETF. Fractional shares allow investors to invest small amounts in expensive securities, which otherwise may be out of their reach. This feature enables investors to select from a broader set of investment opportunities and diversify their portfolio even with limited capital.

Dollar-based Investing and the History of Fractional Shares

Fractional share trading is also called dollar-based investing and is generally a result of the dividend reinvestment plans (DRIPs), reverse stock splits, or similar corporate activities. During such activities, partial stock holdings may get created. Historically, it wasn’t easy to acquire fractional shares since you could not buy or sell them on the stock market.

Benefits of Fractional Shares

Fractional shares function precisely the way they sound – a fraction of a full share. Because the value of a fractional share is less than a full share, it allows a smaller amount of investment.

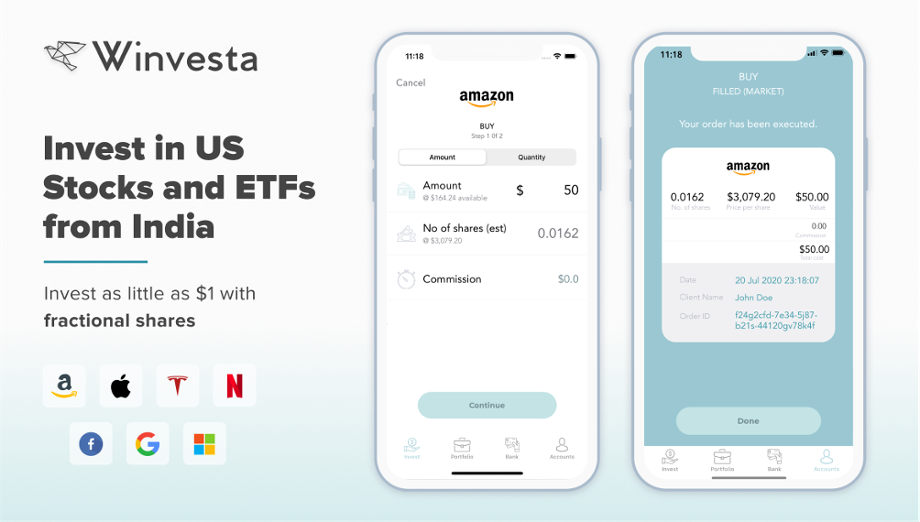

As an example, consider a company with a share price of $1000. With fractional share trading, you can invest as little as $10 and own a 1% of a share.

One key benefit of fractional investing is that it allows new or conservative investors to enter the market with limited risk. Without fraction shares, it would be difficult for an average investor to build a portfolio with Tesla, Amazon, Netflix, or Google stocks, as each would cost hundreds of dollars. An Indian investor who wants to start with say Rs. 1 lakh (US$1300), would not be able to buy all these four stocks. Fractional investing has made it convenient for new as well as seasoned investors to invest in their favoured stocks.

Note that you do not get voting rights on the fractional shares that you own. You will still have the voting right for each full share that you hold in the same company. Dividends, however, are distributed proportionally to the fraction of the share that you own, rounded down to the nearest cent.

How Are Fractional Shares Formed?

As mentioned before, fractional shares can be a result of different corporate activities such as mergers and acquisitions, stock splits, or DRIPs. Additionally, many brokerage firms now allow you to invest in fractional shares.

Let’s have a quick overview of these methods.

Mergers and Acquisitions

M&A activity may lead to the creation of fractional shares since companies merge to form a new stock with a preset ratio. For example, if you hold 5 shares of company B, which is merging with company A and converting the shares 1-for-3 in the new company C, then you would now have 1.67 shares of C post-merger.

Stock Split

Stock splits don’t necessarily produce an even number of shares. If a company announces a 3-for-2 stock split, an investor will have three shares for every two shares they own. Thus, an investor with an odd number of shares will have a fractional share after the split. So, five shares will become seven and a half, or seven shares will become ten and a half, and so on.

Dividend Reinvestment Plans

DRIPs often result in fractional shares as the company or the brokerage firm allows investors to use the dividend payouts to buy more of the same shares. As the dividend is used to purchase the same stocks, some of it may not be enough to buy a full share, resulting in fractional shares.

Investing in Fractional Shares

A few brokerages and trading platforms now allow fractional investing. For example, you may invest as little as $1 in your favourite stocks with Winvesta, and start building a diversified portfolio.

Contributed by Prateek Jain

He is the Co-founder & President of Winvesta. Before Winvesta, Prateek worked at Deutsche Bank for 11 years