Cost of goods sold (COGS)

What is

Cost of goods sold?

Accounts payable (AP) refers to the short-term obligations a business owes to its suppliers or vendors for goods and services received on credit. These liabilities are recorded as current liabilities on the balance sheet and must typically be settled within agreed payment terms, such as 30, 60, or 90 days.

Key takeaways

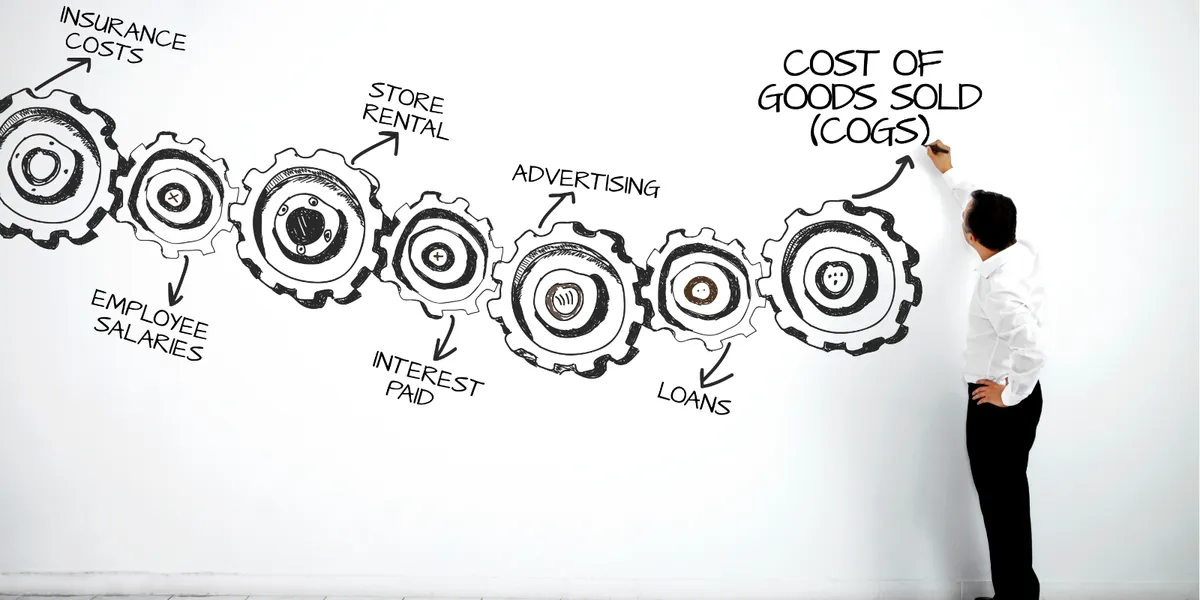

Represents the direct costs of producing goods or providing services

Crucial for calculating gross profit and profit margins.

Includes raw materials, direct labour, and manufacturing overhead.

Excludes indirect expenses like marketing and distribution costs

Impacts pricing decisions and overall profitability

Why accounts payable matters?

Cost of goods sold is a fundamental concept in accounting and business operations. It directly affects a company's profitability and is used to calculate critical financial metrics. COGS typically includes:

- Raw materials: The cost of materials used to create the product.

- Direct labour: Wages paid to workers directly involved in production.

- Manufacturing overhead: Costs like factory rent, utilities, and equipment depreciation.

The basic formula for calculating COGS is:

COGS=BeginningInventory+Purchases−EndingInventoryCOGS=BeginningInventory+Purchases−EndingInventory

Understanding COGS is crucial for:

- Determining gross profit (Revenue - COGS)

- Calculating profit margins

- Making pricing decisions

- Evaluating operational efficiency

- Tax reporting purposes

COGS is reported on the income statement and directly impacts a company's bottom line. Lower COGS relative to revenue generally indicates higher profitability.

Real-world examples

Case study: Apple's iPhone production

Apple's COGS for iPhones includes costs of components like screens and processors, labour in assembly plants, and a portion of manufacturing facility costs. In 2022, Apple reported a cost of goods sold (COGS) of $218.8 billion, reflecting the high costs of producing its premium devices.

Case study: Coca-Cola's beverage production

Coca-Cola's COGS include ingredients like sugar and flavouring, packaging materials, and direct labour costs for bottling operations. In 2022, Coca-Cola reported a cost of goods sold (COGS) of $13.2 billion, demonstrating the significant costs involved in producing and packaging beverages on a global scale.

Case study: Nike's footwear manufacturing

Nike's COGS encompasses materials like rubber and textiles, labour costs in contracted factories, and shipping of materials. In fiscal year 2022, Nike reported a cost of goods sold (COGS) of $24.4 billion, highlighting the substantial costs involved in producing and sourcing athletic footwear and apparel.

Case study: Amazon's e-commerce operations

For Amazon's retail operations, COGS includes the purchase price of products sold, inbound shipping costs, and direct labour for fulfilment centres. In 2022, Amazon reported a COGS of $289.7 billion, reflecting the massive scale of its retail operations.

Disclaimer: The information provided in this business glossary is for educational purposes only and should not be considered as financial advice. Always consult with qualified financial professionals before making investment decisions.

Get paid globally. Keep more of it.

No FX markups. No GST. Funds in 1 day.

Table of Contents

What is

Cost of goods sold?

Accounts payable (AP) refers to the short-term obligations a business owes to its suppliers or vendors for goods and services received on credit. These liabilities are recorded as current liabilities on the balance sheet and must typically be settled within agreed payment terms, such as 30, 60, or 90 days.

Key takeaways

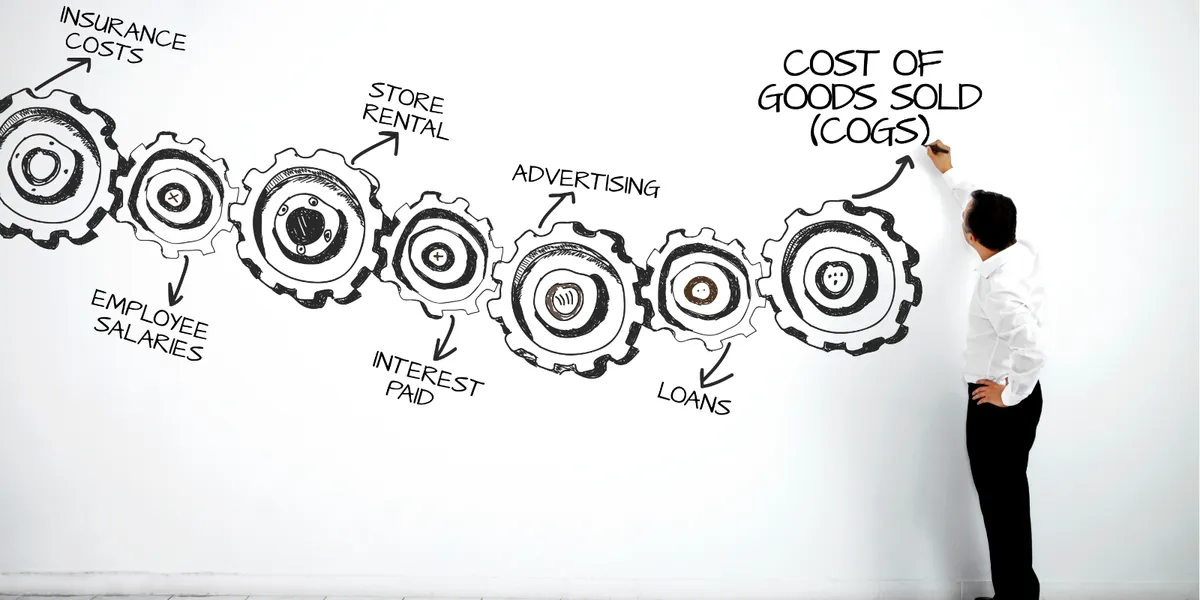

Represents the direct costs of producing goods or providing services

Crucial for calculating gross profit and profit margins.

Includes raw materials, direct labour, and manufacturing overhead.

Excludes indirect expenses like marketing and distribution costs

Impacts pricing decisions and overall profitability

Why accounts payable matters?

Cost of goods sold is a fundamental concept in accounting and business operations. It directly affects a company's profitability and is used to calculate critical financial metrics. COGS typically includes:

- Raw materials: The cost of materials used to create the product.

- Direct labour: Wages paid to workers directly involved in production.

- Manufacturing overhead: Costs like factory rent, utilities, and equipment depreciation.

The basic formula for calculating COGS is:

COGS=BeginningInventory+Purchases−EndingInventoryCOGS=BeginningInventory+Purchases−EndingInventory

Understanding COGS is crucial for:

- Determining gross profit (Revenue - COGS)

- Calculating profit margins

- Making pricing decisions

- Evaluating operational efficiency

- Tax reporting purposes

COGS is reported on the income statement and directly impacts a company's bottom line. Lower COGS relative to revenue generally indicates higher profitability.

Real-world examples

Case study: Apple's iPhone production

Apple's COGS for iPhones includes costs of components like screens and processors, labour in assembly plants, and a portion of manufacturing facility costs. In 2022, Apple reported a cost of goods sold (COGS) of $218.8 billion, reflecting the high costs of producing its premium devices.

Case study: Coca-Cola's beverage production

Coca-Cola's COGS include ingredients like sugar and flavouring, packaging materials, and direct labour costs for bottling operations. In 2022, Coca-Cola reported a cost of goods sold (COGS) of $13.2 billion, demonstrating the significant costs involved in producing and packaging beverages on a global scale.

Case study: Nike's footwear manufacturing

Nike's COGS encompasses materials like rubber and textiles, labour costs in contracted factories, and shipping of materials. In fiscal year 2022, Nike reported a cost of goods sold (COGS) of $24.4 billion, highlighting the substantial costs involved in producing and sourcing athletic footwear and apparel.

Case study: Amazon's e-commerce operations

For Amazon's retail operations, COGS includes the purchase price of products sold, inbound shipping costs, and direct labour for fulfilment centres. In 2022, Amazon reported a COGS of $289.7 billion, reflecting the massive scale of its retail operations.

Disclaimer: The information provided in this business glossary is for educational purposes only and should not be considered as financial advice. Always consult with qualified financial professionals before making investment decisions.

Get paid globally. Keep more of it.

No FX markups. No GST. Funds in 1 day.