Wall Street wakes up to 2026: What the first trading day is really telling us

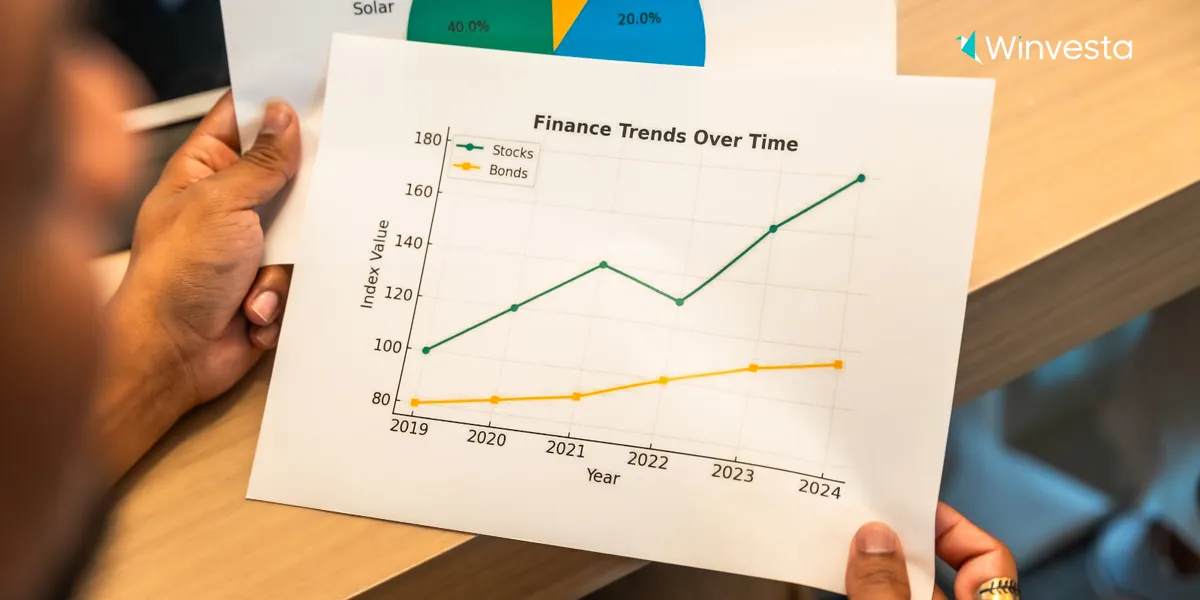

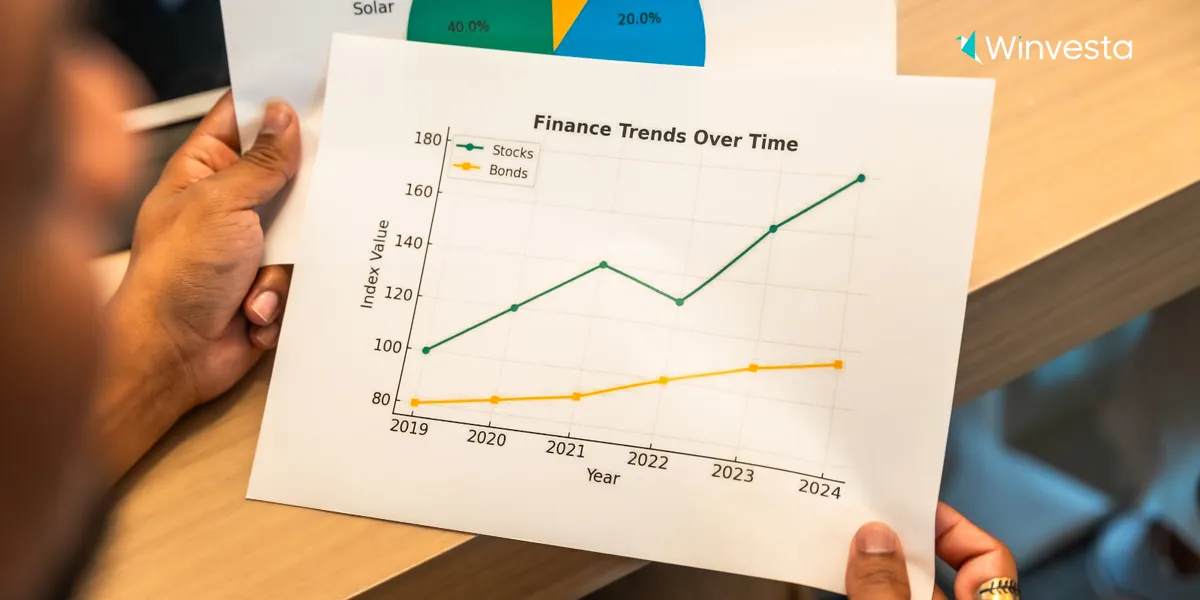

The screens flicker back to life tonight as Wall Street returns from its New Year pause, but the story did not start today – it has been building for three years. US stocks have just logged another year of double‑digit gains, fuelled by artificial intelligence, resilient earnings, and growing expectations that the Federal Reserve will cut rates again in 2026. The question as traders sit down for the first session of the year is simple: can the rally really continue?

A quiet open after a loud year

For a moment, things look calm.

US stock exchanges were shut for New Year’s Day, so today’s tone has been set by futures trading rather than the cash market. Index futures for the Dow, S&P 500 and Nasdaq are nudging higher, hinting at a gentle, positive open rather than fireworks.

Yet beneath that soft start lies a loud backdrop.

The S&P 500, Nasdaq and Dow all finished 2025 with strong double‑digit gains, even after a slightly sour final session where all three indices slipped as investors took profits in big tech. The Dow still closed around the 48,000 mark, the S&P in the mid‑6800s, and the Nasdaq near 23,200 – levels that would have seemed ambitious just a couple of years ago.

In other words, the market is not opening from a place of fear. It is opening from a place of hope – and that is exactly what makes some professionals nervous. Ed Yardeni of Yardeni Research expects the S&P 500 to climb to about 7,700 by the end of 2026, nearly a 12% gain from current levels, but he also admits that the near‑unanimous optimism gives him pause, saying that pessimism “is on the way out right now”, which in itself can be a warning sign.

The 2026 story: AI dreams, rate cuts and quiet doubts

As the bell rings, traders are not just reacting to prices; they are reacting to a narrative that is already well‑formed.

On one side are the bulls. Strategists at major banks see another year of gains ahead, built on a “trifecta” of easier Fed policy, solid US growth, and an AI‑driven surge in productivity and earnings. Goldman Sachs’ equity team captures the mood, saying they maintain a positive view on equities in 2026, even if index returns may be lower than in 2025 as the bull market broadens out. Analysts at JPMorgan talk about an “AI‑fuelled supercycle” pushing record capital spending and faster earnings growth, a phrase that has become a kind of mantra for tech optimists.

Tech remains at the heart of the story.

Dan Ives of Wedbush has picked familiar names – Nvidia, Microsoft, Tesla and Palantir – as his top ideas for 2026, arguing that the AI revolution is “still in the early innings”. At the same time, other strategists are starting to talk about rotation rather than pure tech dominance, pointing to sectors such as healthcare, industrials and even old‑economy financials as likely beneficiaries if the rally spreads out across the market.

Then there are the quieter voices.

Managers at firms like Vanguard warn that while US technology shares can keep riding the AI wave, risks are “growing” as valuations stretch and expectations rise. Some long‑time sceptics argue that equity prices have drifted away from fundamentals, and Morgan Stanley talks openly about potential “curveballs” in 2026, from wobbling credit markets to disappointment in AI returns.

So as US markets reopen tonight for investors watching from India, the scene is set. Futures point to a mild, almost polite, green start, but the real drama lies in the year ahead: whether AI can keep justifying the hype, whether the Fed can cut rates without breaking confidence, and whether this bull market broadens out or burns out. For now, Wall Street is giving the benefit of the doubt, and writing the first lines of what could be a very interesting 2026.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs

The screens flicker back to life tonight as Wall Street returns from its New Year pause, but the story did not start today – it has been building for three years. US stocks have just logged another year of double‑digit gains, fuelled by artificial intelligence, resilient earnings, and growing expectations that the Federal Reserve will cut rates again in 2026. The question as traders sit down for the first session of the year is simple: can the rally really continue?

A quiet open after a loud year

For a moment, things look calm.

US stock exchanges were shut for New Year’s Day, so today’s tone has been set by futures trading rather than the cash market. Index futures for the Dow, S&P 500 and Nasdaq are nudging higher, hinting at a gentle, positive open rather than fireworks.

Yet beneath that soft start lies a loud backdrop.

The S&P 500, Nasdaq and Dow all finished 2025 with strong double‑digit gains, even after a slightly sour final session where all three indices slipped as investors took profits in big tech. The Dow still closed around the 48,000 mark, the S&P in the mid‑6800s, and the Nasdaq near 23,200 – levels that would have seemed ambitious just a couple of years ago.

In other words, the market is not opening from a place of fear. It is opening from a place of hope – and that is exactly what makes some professionals nervous. Ed Yardeni of Yardeni Research expects the S&P 500 to climb to about 7,700 by the end of 2026, nearly a 12% gain from current levels, but he also admits that the near‑unanimous optimism gives him pause, saying that pessimism “is on the way out right now”, which in itself can be a warning sign.

The 2026 story: AI dreams, rate cuts and quiet doubts

As the bell rings, traders are not just reacting to prices; they are reacting to a narrative that is already well‑formed.

On one side are the bulls. Strategists at major banks see another year of gains ahead, built on a “trifecta” of easier Fed policy, solid US growth, and an AI‑driven surge in productivity and earnings. Goldman Sachs’ equity team captures the mood, saying they maintain a positive view on equities in 2026, even if index returns may be lower than in 2025 as the bull market broadens out. Analysts at JPMorgan talk about an “AI‑fuelled supercycle” pushing record capital spending and faster earnings growth, a phrase that has become a kind of mantra for tech optimists.

Tech remains at the heart of the story.

Dan Ives of Wedbush has picked familiar names – Nvidia, Microsoft, Tesla and Palantir – as his top ideas for 2026, arguing that the AI revolution is “still in the early innings”. At the same time, other strategists are starting to talk about rotation rather than pure tech dominance, pointing to sectors such as healthcare, industrials and even old‑economy financials as likely beneficiaries if the rally spreads out across the market.

Then there are the quieter voices.

Managers at firms like Vanguard warn that while US technology shares can keep riding the AI wave, risks are “growing” as valuations stretch and expectations rise. Some long‑time sceptics argue that equity prices have drifted away from fundamentals, and Morgan Stanley talks openly about potential “curveballs” in 2026, from wobbling credit markets to disappointment in AI returns.

So as US markets reopen tonight for investors watching from India, the scene is set. Futures point to a mild, almost polite, green start, but the real drama lies in the year ahead: whether AI can keep justifying the hype, whether the Fed can cut rates without breaking confidence, and whether this bull market broadens out or burns out. For now, Wall Street is giving the benefit of the doubt, and writing the first lines of what could be a very interesting 2026.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs