Motilal Oswal NASDAQ 100 ETF vs direct US investment: Which to choose?

Indian investors seeking NASDAQ-100 exposure face a critical decision in 2026. The Motilal Oswal NASDAQ 100 ETF offers rupee-denominated convenience but carries a 0.58% expense ratio and significant tracking issues. Direct investment in QQQ or QQQM delivers lower costs at 0.15-0.18% but requires LRS compliance and tax complexity. SEBI's $1 billion ETF-specific overseas investment cap reached its limit in April 2024, creating supply constraints that have pushed Indian ETFs to trade at a 12-18% premium to NAV. This guide breaks down costs, returns, taxes, and convenience to help you choose the right path.

Cost comparison reveals expense ratio is just the beginning

The Motilal Oswal NASDAQ 100 ETF charges 0.58% annual expense ratio. This appears reasonable until you compare it with U.S. alternatives. QQQ reduced its expense ratio to 0.18% in December 2025 after converting from a Unit Investment Trust to an open-end ETF. QQQM charges just 0.15%, making it the cheapest NASDAQ-100 option globally.

Direct investment involves additional costs beyond expense ratios. Forex conversion through Interactive Brokers costs just 0.002% of the transaction amount. Other platforms charge more: Vested Finance at approximately 1.2% forex markup and INDmoney at roughly 1% plus a 0.75% platform fee. Brokerage commissions range from $0.35-1.00 per trade on Interactive Brokers to 0.25% on Vested Finance.

The Indian ETF carries hidden costs. STT applies at 0.001% on sales transactions. Demat account charges range from ₹300 to ₹ 500 annually. Brokerage ranges from 0.01-0.03% per trade. The Fund of Fund route adds 0.22% expense ratio on top of the underlying ETF's 0.58%, resulting in approximately 0.80% total annual cost.

TCS at 20% applies to remittances above ₹10 lakh for direct investment. However, this amount is fully refundable as a tax credit when filing ITR. It represents a cash-flow impact, not a permanent cost. Break-even analysis shows that direct investment becomes cheaper above ₹3-5 lakh due to a significant difference in expense ratios.

| Cost component | Indian ETF route | Direct US investment |

|---|---|---|

| Expense ratio | 0.58% (ETF) or 0.80% (FoF) | 0.15-0.18% |

| Forex conversion | None | 0.002-1.2% |

| Brokerage per trade | 0.01-0.03% | $0.35-1.00 flat |

| Annual demat charges | ₹300-500 | None |

| TCS above ₹10 lakh | None | 20% (refundable) |

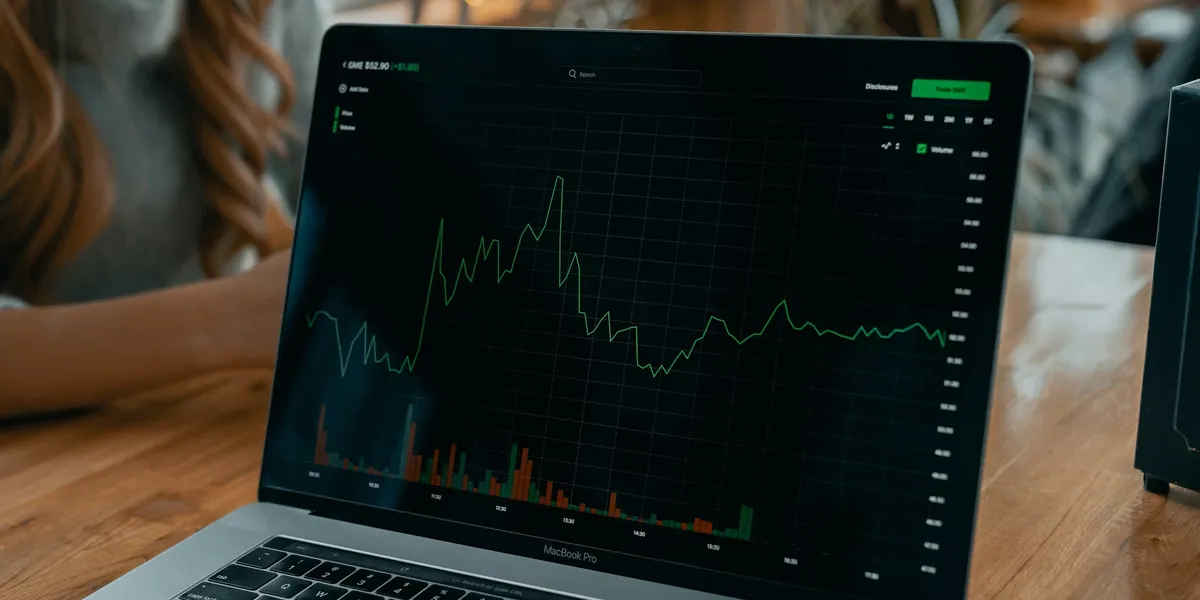

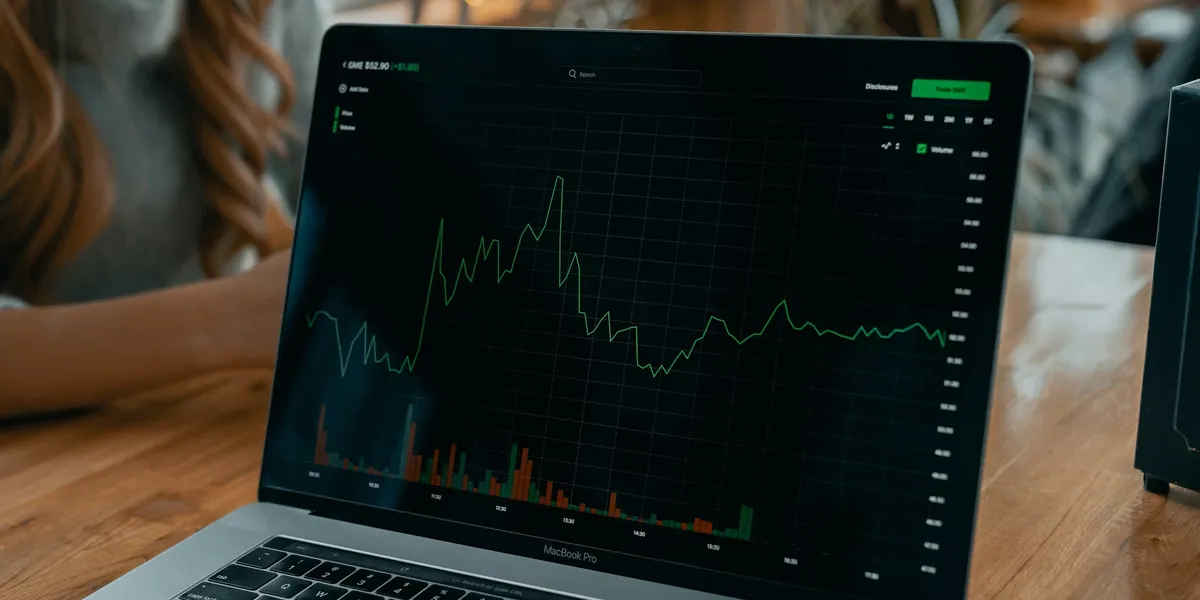

Return comparison shows tracking error erodes Indian fund returns

The NASDAQ-100 delivered 20.77% returns in 2025 and 25.58% in 2024. QQQ and QQQM track these returns almost perfectly with a tracking error of just 0.09-0.20%. The expense ratio accounts for nearly all of the performance drag.

Motilal Oswal NASDAQ 100 ETF tells a different story. While the fund reports a a 0.06% tracking error, the actual tracking difference ranges from 2% to 6% annually, according to independent analysis. This gap far exceeds the stated expense ratio.

Historical data reveals the extent of underperformance. During July 2020-2021, the NASDAQ-100 returned 43% while the ETF NAV delivered only 37.2%, creating a 5.8% gap. Similar patterns appear across multiple years, with tracking differences of 2.5-3.0% being common.

Several factors cause this drag. The U.S. dividend withholding tax (US15-2%) reduces returns because the benchmark assumes full dividend reinvestment. Cash drag from settlement timing and currency conversion delays compounds this effect. Rebalancing execution costs and NAV timing differences add further slippage.

On a ₹10 lakh investment, the tracking difference costs ₹20,000-60,000 annually with the Indian ETF versus just ₹1,800-2,000 with QQQ. Over a 10-year horizon, this compounds into lakhs of rupees in lost returns.

The rupee's historical depreciation of 3-4% annually against the dollar benefits both routes equally. From 2015 to 2025, the rupee fell from ₹62.78 to ₹87.1, providing a 38% tailwind to U.S. asset returns measured in INR terms.

Tax treatment differences affect compliance, not rates

Budget 2024 significantly changed the tax landscape. Both Indian international funds and direct U.S. investments now face a 12.5% USTCG tax after a 24-month holding period, without indexation benefits. Short-term gains are taxed at individual slab rates under both routes.

Neither route qualifies for the ₹1.25 lakh LTCG exemption available to domestic equity funds. This gives international exposure a tax disadvantage relative to the Nifty 50 or domestic equity mutual funds.

The critical difference lies in compliance complexity, not tax rates. The Indian ETF route requires no Schedule FA disclosure, no FEMA compliance, and simple ITR-2 filing. Direct U.S. investment requires ScheduleUSA mandatory disclosure, with a ₹10 lakh penalty per year for non-disclosure. Form 67 filing becomes necessary to claim the Foreign Tax Credit on U.S. dividend withholding. ScheduUS FSI and Schedule TR add complexity to ITR filing.

U.S. estate tax creates serious concern for direct investors. Non-resident aliens receive only a $60,000 exemption, compared with $13.61 million for U.S. citizens. Amounts above the threshold are subject to graduated rates up to 40%. A $500,000 portfolio could trigger $176,000 in estate tax liability upon death.

U.S. dividend withholding at 25% USplies when a Form 1042-S is filed for direct investment. The Foreign Tax Credit can offset Indian taxes on the same income, but requires Form 67 to be submitted.

For step-by-step guidance on DTAA benefits, Form 67 filing, and capital gains calculations, explore our detailed guide on how to handle U.S. stock taxation in India.

The Indian fund faces similar withholding at the portfolio level, creating comparable dividend drag.

Convenience factor favours Indian ETF for smaller portfolios

The Indian ETF route offers significant advantages in simplicity. You invest in rupees through your existing demat account. No LRS paperwork or Form A2 documentation required. No bank visits for foreign remittance. Portfolio tracking is available through familiar Indian platforms such as Zerodha and Groww.

Direct investment requires opening an international brokerage account with Interactive Brokers Vested or similar platforms.

For a detailed breakdown of fees, features, and user experience across different brokers, read our comprehensive guide to comparing U.S. stock trading platforms available to Indian investors.

LRS compliance includes Form A2 submission for every remittance. Bank processes vary, but typically require in-person visits for amounts above ₹5 lakh. Currency conversion timing affects purchase price,s especially during volatile forex markets.

Tax filing complexity increases substantially with direct investment. You must report foreign assets in Schedule FA regardless of whether you sold anything during the year. Dividend income requires Schedule FSI reporting. Capital gains need Schedule TR entries. Missing any disclosure trigger, resulting in a ₹10 lakh penalty under Black Money Act provisions.

The Fund of Funds structure offered SIP convenience until January 2025, when Motilal Oswal suspended all existing SIPs due to SEBI limits. No reliable Indian NASDAQ-100 SIP option currently exists. Direct investors can set up manual monthly purchase routines in Interactive Brokers, but must handle LRS paperwork each time.

Tracking error analysis reveals the Indian ETF's core weakness.

Tracking error measures the volatility of the difference between the returns of an ETF and its benchmark. Tracking difference measures the actual cumulative performance gap. Both metrics matter, but tracking differences affects your wealth more directly.

QQQ achieves a tracking error of 0.09-0.20%, with the tracking difference almost exactly matching its expense ratio. This represents near-perfect index replication. QQQM shows similar characteristics with a marginally better tracking difference due to its lower expense ratio.

Motilal Oswal reports 0.06% tracking error in official documents. However,r this metric masks the accurate picture. The tracking difference often exceeds 2-3% annually. Causes include the fund's structure, which holds NASDAQ-100 stocks directly but faces currency conversion friction and dividend withholding impacts.

The ETF's NAV uses U.S. closing prices from the previous day, whereas market prices reflect overnight developments. This creates arbitrage opportunities during volatile periods. When SEBI limits prevent unit creation, these arbitrage mechanisms break down, causing persistent premiums.

Current premium-to-NAV ranges from 12% to 18%, depending on market conditions. This means paying ₹214 for holdings worth only ₹181. The premium could evaporate instantly if regulatory limits ease, creating immediate unrealised losses for recent buyers.

Liquidity considerations affect trading costs.

QQQ ranks among the most liquid ETFs globally, with an average daily trading volume of 53 million and bid-ask spreads of just $0.01. QQQM shows lower but adequate liquidity at approximately 5.4 million daily volume with similar tight spreads.

Motilal Oswal NASDAQ 100 ETF trades on the NSE with significantly lower volumes. Market-maker activity exists, but spreads widen during volatile periods. The suspended unit creation mechanism removes the natural arbitrage that keeps prices aligned with NAV.

For investments under ₹10 lakh, the Indian ETFs' liquidity suffices for regular trading. Larger transactions may experience slippage, especially during market hours when underlying NASDAQ-listed stocks aren't trading. Using limit orders becomes essential to avoid paying excessive premiums.

Direct investment in QQQ or QQQM faces no practical liquidity constraints at any reasonable investment size. Orders execute at tight spreads during U.S. market hours. Extended-USur trading provides additional flexibility, though with wider spreads.

Which route suits different investment amounts

Small investors with less than ₹3 lakh should prefer the Indian ETF route despite higher costs. The advantages of simplicity outweigh the difference in expense ratios. Fixed costs of direct investment, including platform fees and compliance efforts, don't justify the savings at this scale. Monitor NAV premium closely and avoid purchases above 2% pof NAV.

Medium investors between ₹5-20 lakh should consider direct investment through Interactive Brokers. Annual savings of ₹2,000-12,000 compound meaningfully over time. QQQM offers the best combination of low costs and adequate liquidity for buy-and-hold investors. Accept additional tax compliance as the price for significant cost savings.

Large investors with balances above ₹20 lakh clearly benefit from direct investment, with annual savings exceeding ₹10,000. However, U.S estate tax exposure requires careful planning once holdings exceed $60,000 in equivalent value. Strategies include gifting during lifetime, maintaining some allocation in Indian funds for estate protection, or adequate life insurance coverage.

Investors seeking SIP convenience face limited options. Until SEBI increases overseas investment limits, there is no reliable Indian NASDAQ-100 Sts. Consider alternative funds like Kotak or Navi NASDAQ 100 FoF, which remain partially open. Direct investors can set up manual monthly purchase routines, but they must accept the recurring LRS documentation burden.

The regulatory outlook remains uncertain. SEBI has considered increasing the $7 billion industry limit, but RBI approval is required. Until the limits expand, the Indian ETF will continue to trade at a premium, making direct investment more attractive for cost-conscious investors with adequate compliance tolerance. For most investors with balances above ₹5 lakh, Interactive Brokers plus QQQM offers the optimal combination of low costs, accurate tracking, and manageable compliance requirements.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs

Table of Contents

No h1 or h2 headings found in this article.

Indian investors seeking NASDAQ-100 exposure face a critical decision in 2026. The Motilal Oswal NASDAQ 100 ETF offers rupee-denominated convenience but carries a 0.58% expense ratio and significant tracking issues. Direct investment in QQQ or QQQM delivers lower costs at 0.15-0.18% but requires LRS compliance and tax complexity. SEBI's $1 billion ETF-specific overseas investment cap reached its limit in April 2024, creating supply constraints that have pushed Indian ETFs to trade at a 12-18% premium to NAV. This guide breaks down costs, returns, taxes, and convenience to help you choose the right path.

Cost comparison reveals expense ratio is just the beginning

The Motilal Oswal NASDAQ 100 ETF charges 0.58% annual expense ratio. This appears reasonable until you compare it with U.S. alternatives. QQQ reduced its expense ratio to 0.18% in December 2025 after converting from a Unit Investment Trust to an open-end ETF. QQQM charges just 0.15%, making it the cheapest NASDAQ-100 option globally.

Direct investment involves additional costs beyond expense ratios. Forex conversion through Interactive Brokers costs just 0.002% of the transaction amount. Other platforms charge more: Vested Finance at approximately 1.2% forex markup and INDmoney at roughly 1% plus a 0.75% platform fee. Brokerage commissions range from $0.35-1.00 per trade on Interactive Brokers to 0.25% on Vested Finance.

The Indian ETF carries hidden costs. STT applies at 0.001% on sales transactions. Demat account charges range from ₹300 to ₹ 500 annually. Brokerage ranges from 0.01-0.03% per trade. The Fund of Fund route adds 0.22% expense ratio on top of the underlying ETF's 0.58%, resulting in approximately 0.80% total annual cost.

TCS at 20% applies to remittances above ₹10 lakh for direct investment. However, this amount is fully refundable as a tax credit when filing ITR. It represents a cash-flow impact, not a permanent cost. Break-even analysis shows that direct investment becomes cheaper above ₹3-5 lakh due to a significant difference in expense ratios.

| Cost component | Indian ETF route | Direct US investment |

|---|---|---|

| Expense ratio | 0.58% (ETF) or 0.80% (FoF) | 0.15-0.18% |

| Forex conversion | None | 0.002-1.2% |

| Brokerage per trade | 0.01-0.03% | $0.35-1.00 flat |

| Annual demat charges | ₹300-500 | None |

| TCS above ₹10 lakh | None | 20% (refundable) |

Return comparison shows tracking error erodes Indian fund returns

The NASDAQ-100 delivered 20.77% returns in 2025 and 25.58% in 2024. QQQ and QQQM track these returns almost perfectly with a tracking error of just 0.09-0.20%. The expense ratio accounts for nearly all of the performance drag.

Motilal Oswal NASDAQ 100 ETF tells a different story. While the fund reports a a 0.06% tracking error, the actual tracking difference ranges from 2% to 6% annually, according to independent analysis. This gap far exceeds the stated expense ratio.

Historical data reveals the extent of underperformance. During July 2020-2021, the NASDAQ-100 returned 43% while the ETF NAV delivered only 37.2%, creating a 5.8% gap. Similar patterns appear across multiple years, with tracking differences of 2.5-3.0% being common.

Several factors cause this drag. The U.S. dividend withholding tax (US15-2%) reduces returns because the benchmark assumes full dividend reinvestment. Cash drag from settlement timing and currency conversion delays compounds this effect. Rebalancing execution costs and NAV timing differences add further slippage.

On a ₹10 lakh investment, the tracking difference costs ₹20,000-60,000 annually with the Indian ETF versus just ₹1,800-2,000 with QQQ. Over a 10-year horizon, this compounds into lakhs of rupees in lost returns.

The rupee's historical depreciation of 3-4% annually against the dollar benefits both routes equally. From 2015 to 2025, the rupee fell from ₹62.78 to ₹87.1, providing a 38% tailwind to U.S. asset returns measured in INR terms.

Tax treatment differences affect compliance, not rates

Budget 2024 significantly changed the tax landscape. Both Indian international funds and direct U.S. investments now face a 12.5% USTCG tax after a 24-month holding period, without indexation benefits. Short-term gains are taxed at individual slab rates under both routes.

Neither route qualifies for the ₹1.25 lakh LTCG exemption available to domestic equity funds. This gives international exposure a tax disadvantage relative to the Nifty 50 or domestic equity mutual funds.

The critical difference lies in compliance complexity, not tax rates. The Indian ETF route requires no Schedule FA disclosure, no FEMA compliance, and simple ITR-2 filing. Direct U.S. investment requires ScheduleUSA mandatory disclosure, with a ₹10 lakh penalty per year for non-disclosure. Form 67 filing becomes necessary to claim the Foreign Tax Credit on U.S. dividend withholding. ScheduUS FSI and Schedule TR add complexity to ITR filing.

U.S. estate tax creates serious concern for direct investors. Non-resident aliens receive only a $60,000 exemption, compared with $13.61 million for U.S. citizens. Amounts above the threshold are subject to graduated rates up to 40%. A $500,000 portfolio could trigger $176,000 in estate tax liability upon death.

U.S. dividend withholding at 25% USplies when a Form 1042-S is filed for direct investment. The Foreign Tax Credit can offset Indian taxes on the same income, but requires Form 67 to be submitted.

For step-by-step guidance on DTAA benefits, Form 67 filing, and capital gains calculations, explore our detailed guide on how to handle U.S. stock taxation in India.

The Indian fund faces similar withholding at the portfolio level, creating comparable dividend drag.

Convenience factor favours Indian ETF for smaller portfolios

The Indian ETF route offers significant advantages in simplicity. You invest in rupees through your existing demat account. No LRS paperwork or Form A2 documentation required. No bank visits for foreign remittance. Portfolio tracking is available through familiar Indian platforms such as Zerodha and Groww.

Direct investment requires opening an international brokerage account with Interactive Brokers Vested or similar platforms.

For a detailed breakdown of fees, features, and user experience across different brokers, read our comprehensive guide to comparing U.S. stock trading platforms available to Indian investors.

LRS compliance includes Form A2 submission for every remittance. Bank processes vary, but typically require in-person visits for amounts above ₹5 lakh. Currency conversion timing affects purchase price,s especially during volatile forex markets.

Tax filing complexity increases substantially with direct investment. You must report foreign assets in Schedule FA regardless of whether you sold anything during the year. Dividend income requires Schedule FSI reporting. Capital gains need Schedule TR entries. Missing any disclosure trigger, resulting in a ₹10 lakh penalty under Black Money Act provisions.

The Fund of Funds structure offered SIP convenience until January 2025, when Motilal Oswal suspended all existing SIPs due to SEBI limits. No reliable Indian NASDAQ-100 SIP option currently exists. Direct investors can set up manual monthly purchase routines in Interactive Brokers, but must handle LRS paperwork each time.

Tracking error analysis reveals the Indian ETF's core weakness.

Tracking error measures the volatility of the difference between the returns of an ETF and its benchmark. Tracking difference measures the actual cumulative performance gap. Both metrics matter, but tracking differences affects your wealth more directly.

QQQ achieves a tracking error of 0.09-0.20%, with the tracking difference almost exactly matching its expense ratio. This represents near-perfect index replication. QQQM shows similar characteristics with a marginally better tracking difference due to its lower expense ratio.

Motilal Oswal reports 0.06% tracking error in official documents. However,r this metric masks the accurate picture. The tracking difference often exceeds 2-3% annually. Causes include the fund's structure, which holds NASDAQ-100 stocks directly but faces currency conversion friction and dividend withholding impacts.

The ETF's NAV uses U.S. closing prices from the previous day, whereas market prices reflect overnight developments. This creates arbitrage opportunities during volatile periods. When SEBI limits prevent unit creation, these arbitrage mechanisms break down, causing persistent premiums.

Current premium-to-NAV ranges from 12% to 18%, depending on market conditions. This means paying ₹214 for holdings worth only ₹181. The premium could evaporate instantly if regulatory limits ease, creating immediate unrealised losses for recent buyers.

Liquidity considerations affect trading costs.

QQQ ranks among the most liquid ETFs globally, with an average daily trading volume of 53 million and bid-ask spreads of just $0.01. QQQM shows lower but adequate liquidity at approximately 5.4 million daily volume with similar tight spreads.

Motilal Oswal NASDAQ 100 ETF trades on the NSE with significantly lower volumes. Market-maker activity exists, but spreads widen during volatile periods. The suspended unit creation mechanism removes the natural arbitrage that keeps prices aligned with NAV.

For investments under ₹10 lakh, the Indian ETFs' liquidity suffices for regular trading. Larger transactions may experience slippage, especially during market hours when underlying NASDAQ-listed stocks aren't trading. Using limit orders becomes essential to avoid paying excessive premiums.

Direct investment in QQQ or QQQM faces no practical liquidity constraints at any reasonable investment size. Orders execute at tight spreads during U.S. market hours. Extended-USur trading provides additional flexibility, though with wider spreads.

Which route suits different investment amounts

Small investors with less than ₹3 lakh should prefer the Indian ETF route despite higher costs. The advantages of simplicity outweigh the difference in expense ratios. Fixed costs of direct investment, including platform fees and compliance efforts, don't justify the savings at this scale. Monitor NAV premium closely and avoid purchases above 2% pof NAV.

Medium investors between ₹5-20 lakh should consider direct investment through Interactive Brokers. Annual savings of ₹2,000-12,000 compound meaningfully over time. QQQM offers the best combination of low costs and adequate liquidity for buy-and-hold investors. Accept additional tax compliance as the price for significant cost savings.

Large investors with balances above ₹20 lakh clearly benefit from direct investment, with annual savings exceeding ₹10,000. However, U.S estate tax exposure requires careful planning once holdings exceed $60,000 in equivalent value. Strategies include gifting during lifetime, maintaining some allocation in Indian funds for estate protection, or adequate life insurance coverage.

Investors seeking SIP convenience face limited options. Until SEBI increases overseas investment limits, there is no reliable Indian NASDAQ-100 Sts. Consider alternative funds like Kotak or Navi NASDAQ 100 FoF, which remain partially open. Direct investors can set up manual monthly purchase routines, but they must accept the recurring LRS documentation burden.

The regulatory outlook remains uncertain. SEBI has considered increasing the $7 billion industry limit, but RBI approval is required. Until the limits expand, the Indian ETF will continue to trade at a premium, making direct investment more attractive for cost-conscious investors with adequate compliance tolerance. For most investors with balances above ₹5 lakh, Interactive Brokers plus QQQM offers the optimal combination of low costs, accurate tracking, and manageable compliance requirements.

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to earn on every trade?

Invest in 11,000+ US stocks & ETFs