How To Fund Your Multi-Currency Account From India?

2 minutes read

Winvesta launched India’s first multi-currency account in July last year. It allows Indian residents to diversify and hold their funds abroad. The account enables Indians to receive, save, invest, and spend globally in over 30 currencies.

How Is A Multi-Currency Account Useful?

- Winvesta’s Multi-Currency Account is an offshore 3-in-1 account for your overseas investments, including your brokerage account.

- It enables you to fund investments like real estate, startups, crowdfunding, etc.

- You can also invest in US stocks through the MCA by transferring funds to the brokerage account.

- Additionally, you can also receive passive income, rebates, and dividends in this account and reinvest in other assets.

- A Multi-Currency Account also helps in goal-based investing. For example, if you plan to send your child to the US for higher education, the MCA lets you convert and hold money in US Dollars. This saves you from the risk of the rupee depreciation.

In the absence of an overseas account, liquidating your international investments would mean withdrawing the proceeds back to your Indian bank account. You will spend double on forex charges if you wish to send that money overseas again. Through Winvesta’s MCA, you can reinvest the amount without repatriating the funds to India.

How Can You Fund The MCA?

- Step 1: Log in to Winvesta Direct (the MCA Portal), and go to balances. Select the currency through which you want to fund the account (USD, GBP, EUR, AUD, CAD, etc.)

- Step 2: Click “Account Details” after selecting the currency.

- Step 3: Wire transfers from India are sent as SWIFT Payments. You can find your SWIFT Payment details by finding the relevant section in “account details.” Then, add a beneficiary in your Indian bank account for foreign remittances using the “account details.”

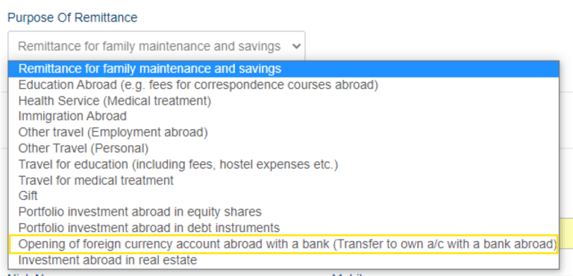

- Step 4: In the bank’s Form A2, select “S0023: Opening of foreign currency account abroad with a bank” as the purpose code for the remittance. Banks with online remittance enabled may show the purpose code in a dropdown with a slight change in the text (Remittance to own account abroad, etc.).

Further Steps

- Step 5: There is NO need to add “further credit to field.” This is because the bank account details are in your name and unique.

- Step 6: If your bank asks for a sort code for the USD account, you can use 041404. The last eight characters of your IBAN is your account number (if needed).

The wire transfer to fund your MCA from your Indian bank account can be done online or through a branch. Banks like ICICI Bank, HDFC Bank, IDFC First Bank, Kotak Mahindra Bank, IndusInd Bank, and Axis Bank allow a complete online digital transfer of funds from your account up to $25K.

In case your bank does not support online remittance, you must fill out the A2 form and submit it at a branch. Winvesta team can help you with that if needed.

After initiating the remittance, send an email to currencyaccounts@winvesta.in with your transfer receipt.

Winvesta, with its multi-currency account, is the hub of all global investments for Indian investors.

Access 4500+ US Stocks and ETFs with Winvesta

Get an account in minutes and start investing as soon as today

Get StartedAll content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember capital is at risk. Terms & Conditions apply.

Contributed by Hormaz Fatakia

Hormaz is the Financial Content Lead at Winvesta. Before Winvesta, Hormaz worked at Bloomberg Quint where he was a senior writer.